Are you looking for an answer to the topic “How is Nic calculated for PAYE?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

Class 1 NIC is generally calculated week by week or month by month, depending on whether your employer pays you weekly or monthly. It is not cumulative like income tax deducted under Pay As You Earn (PAYE). Look at example Karim to see how to work out your NIC. Your employer pays Class 1 NIC on your earnings too.Calculate income tax (PAYE) and National Insurance (NI) contributions plus the effects of salary increases. Your final salary is calculated by deducting income tax and national insurance from your gross salary.Employers pay Class 1 NICs of 15.05% on all earnings above the secondary threshold for almost all employees.

Table of Contents

Is NI calculated on gross or net pay?

Calculate income tax (PAYE) and National Insurance (NI) contributions plus the effects of salary increases. Your final salary is calculated by deducting income tax and national insurance from your gross salary.

How much does an employer contribute to NI?

Employers pay Class 1 NICs of 15.05% on all earnings above the secondary threshold for almost all employees.

How Income Tax (PAYE) and National Insurance (NIC) is calculated

Images related to the topicHow Income Tax (PAYE) and National Insurance (NIC) is calculated

How is NI contribution calculated UK?

For the tax year 2021-22, Class 4 contributions are calculated at the rate of 9% + £3.05 per week if your profits are between £9,569 and £50,270, and if your profits after deducting expenses are above £50,270 then, Class 4 contributions are calculated at the rate of 2% of your profits + £3.05 per week.

What percentage of National Insurance do I pay?

| Your pay | Class 1 National Insurance rate |

|---|---|

| £190 to £967 a week (£823 to £4,189 a month) | 13.25% |

| Over £967 a week (£4,189 a month) | 3.25% |

What percentage is National Insurance and tax?

nothing on the first £190. 13.25% (£102.95) on your earnings between £190.01 and £967. 3.25% (£1.07) on the remaining earnings above £967.

How is employer NIC worked out?

As an employer, you must pay National Insurance on any expenses and benefits you give your employees. You must also pay NICs on some other lump sum payments, such as for redundancy. The rate you pay on benefits for 2020/21 is 13.8%, the same as for other earnings.

What is the employers NI threshold for 2021 22?

| Class 1 National Insurance thresholds | 2021 to 2022 |

|---|---|

| Lower earnings limit | £120 per week £520 per month £6,240 per year |

| Primary threshold | £184 per week £797 per month £9,568 per year |

| Secondary threshold | £170 per week £737 per month £8,840 per year |

See some more details on the topic How is Nic calculated for PAYE? here:

How National Insurance Contributions (NICs) are calculated

Although not a tax, NICs are collected by HMRC mainly through Pay As You Earn (PAYE) taxation, at the same time as income tax is deducted. And …

National Insurance rates – Which? – Which? Magazine

National Insurance is calculated on gross earnings (before tax or pension deductions) or profits (earnings minus allowable expenses) above a threshold. The rate …

How to Calculate National Insurance (NI) for Employees and …

The actual calculation of NICs for employees is done using contribution tables that are given to your employer by HMRC.

Payroll SE: How to confirm PAYE/NIC Calculations

Click Calculate on the relevant employee. The PAYE/NIC values can also be viewed by printing the employees Payslip or running a Pay Summary report. Navigate to …

How much tax does an employer pay for an employee UK?

The current standard rates of employer’s NICs are: £118 to £166 a week—0% £166.01 to £962 a week—8% £962 or more a week—8%

Is National Insurance calculated monthly or annually?

Class 1 NIC is generally calculated week by week or month by month, depending on whether your employer pays you weekly or monthly. It is not cumulative like income tax deducted under Pay As You Earn (PAYE).

How To Calculate UK National Insurance Contribution 2021/22 – Employees and Employer (Basic) Example

Images related to the topicHow To Calculate UK National Insurance Contribution 2021/22 – Employees and Employer (Basic) Example

How much NI do I pay on 200 a week?

On a £200 salary, your take home pay will be £200 after tax and National Insurance. This equates to £17 per month and £4 per week. If you work 5 days per week, this is £1 per day, or £0 per hour at 40 hours per week.

What is the National Insurance threshold for 2020 21?

| £ per week | 2022 to 2023 | 2020 to 2021 |

|---|---|---|

| Upper Earnings Limit (UEL) All employees pay a lower rate of National Insurance above this point | £967 | £962 |

| Upper Secondary Threshold (UST) Employers of employees who are under 21 pay zero rate up to this point | £967 | £962 |

How much more NI will I pay?

How much will the tax changes cost me? From April 2022, anybody earning more than £9,880 a year will pay 1.25p more in the pound. However, from July 2022 the point at which employees start paying NI will increase to £12,570.

What happens if I don’t pay National Insurance contributions?

Your National Insurance Contributions give you access to some benefits including a retirement pension. Thus, if you’re not paying your National Insurance contributions you’ll end up with gaps in your NI record, and won’t be able to qualify for some benefits.

What are the new National Insurance rates?

The hike in national insurance of 1.25 percentage points from April 2022 is earmarked to help the overstretched NHS and “equivalent bodies across the UK”. Employees saw their national insurance contributions increase to 13.25% from 12%.

What percentage of taxes are taken out of my paycheck?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employee’s wages.

What percentage of tax do I pay UK?

| Band | Taxable income | Tax rate |

|---|---|---|

| Personal Allowance | Up to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £150,000 | 40% |

| Additional rate | over £150,000 | 45% |

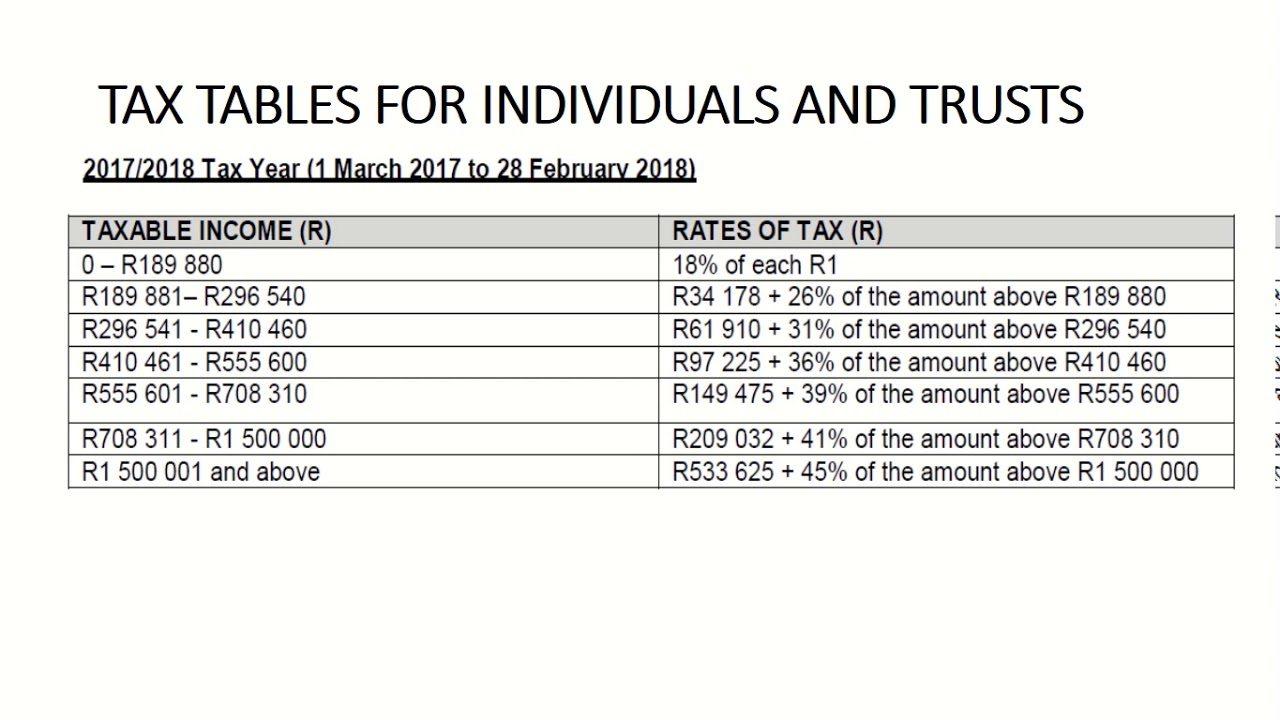

Calculating PAYE

Images related to the topicCalculating PAYE

Can National Insurance be claimed back?

National Insurance refunds

You can claim back any overpaid National Insurance.

Why is employers NI on my payslip?

EMPLOYERS NI / ERS NI Employers also pay Employer’s National Insurance contributions on their employees’ earnings and benefits, which is summarised for reference on your payslip. EARNINGS FOR TAX / EARNINGS FOR NI This is the amount of your earnings that are subject to tax or national insurance deductions.

Related searches to How is Nic calculated for PAYE?

- do i have to pay employers national insurance

- national insurance rates 202223

- national insurance contributions

- what percentage is national insurance

- how is nic calculated for paye

- how is ni calculated on paye

- how do you calculate paye manually

- how much paye and ni will i pay

- what percentage is paye and national insurance

- how much national insurance do i pay self employed

- what happens if i dont earn enough to pay national insurance

- what does national insurance pay for

- national insurance increase 2022

- working part time not paying national insurance

- national insurance rates 2022/23

- national insurance threshold

Information related to the topic How is Nic calculated for PAYE?

Here are the search results of the thread How is Nic calculated for PAYE? from Bing. You can read more if you want.

You have just come across an article on the topic How is Nic calculated for PAYE?. If you found this article useful, please share it. Thank you very much.