Are you looking for an answer to the topic “Does Wayfair check your credit?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

Keep Reading

Table of Contents

Does Wayfair run credit checks?

Yes, the Wayfair Store Card will do a hard pull when you apply for it. This might negatively affect your credit score for a little while. You’ll need at least fair credit to be considered eligible for this card. Fortunately, you can check if you pre-qualify without hurting your credit score.

What credit score do I need for Wayfair?

A FICO® Score of 580 or higher is recommended before applying for the Wayfair Credit Card. Consumers in this range have good approval odds based on reports from previous applicants. When you apply, you’ll be considered for both the Wayfair Credit Card and the Wayfair Mastercard®.

NEW/UPDATED CREDIT CARD: Wayfair Credit Card Review (now issued by Citi)

Images related to the topicNEW/UPDATED CREDIT CARD: Wayfair Credit Card Review (now issued by Citi)

Does Wayfair help build credit?

The Wayfair credit card can help you to build your credit rating. If you use the card responsibly, make all the payments on time and keep the balances low, it can improve your FICO score.

What bank finances Wayfair credit?

The Wayfair Credit Card Program, issued by Comenity Bank, has ended. Your Account is no longer valid for new transactions. However, rewards that you’ve earned through September 10, 2020 can be redeemed until September 10, 2021.

Does affirm run your credit?

Does Affirm check your credit? Affirm will perform a soft credit check. This won’t affect your credit score or show up on your credit report.

Is Wayfair financing safe?

Summary: The Wayfair credit card is designed for frequent shoppers at Wayfair and related stores: Joss & Main, Perigold, Birch Lane, and AllModern. The card allows a choice between rewards and a zero-interest financing plan. Be careful: the APR is sky high and the financing plan comes with a serious risk.

Did wayfair close credit?

Card accounts for Comenity Bank’s Wayfair Credit Card closed on Sept. 10, 2020, although Comenity notes that any rewards you earned through that date can still be redeemed until Sept. 10, 2021.

See some more details on the topic Does Wayfair check your credit? here:

Wayfair Financing: What You Need To Know | Credit Karma

Does Wayfair financing check your credit? With Wayfair financing, you can see which offers you’re …

Does Wayfair check your credit? – WhoMadeWhat

Wayfair Financing is not a credit card program, but Wayfair does offer credit cards. … With our easy process, you can check your eligibility without …

Wayfair lease-to-own made easy – Katapult

Katapult offers a simple, straight-forward lease-to-own financing option to help you get durable goods from top retailers, such as Wayfair, and pay over time.

5 Things to Know About the Wayfair Credit Card – NerdWallet

3. You can take advantage of special financing (but you’ll forgo rewards) · 6-month financing on orders over $199. · 12-month financing on orders over $499. · 18- …

Is Comenity Bank easy to get?

The Comenity Bank credit cards that are easy to get are the ones that require fair credit for approval. That means you’ll need a score of about 640 or higher. And since the average person’s credit score is about 40 points above that, these cards are well within reach for most of us.

What happens if I dont pay Wayfair?

Late Fee: If you do not pay the Minimum Payment by the Due Date, we charge a Late Fee. The fee is $29 if you were not charged a Late Fee during the prior six billing periods. Otherwise, it is $40. This fee will not exceed the amount permitted by law.

Is Fingerhut a hard inquiry?

Yes, the Fingerhut Credit Card will do a hard pull. You can apply for it with no credit though. It has a lower credit-score requirement than most store cards, so you may be able to qualify with bad credit if you have a steady income and not too much debt.

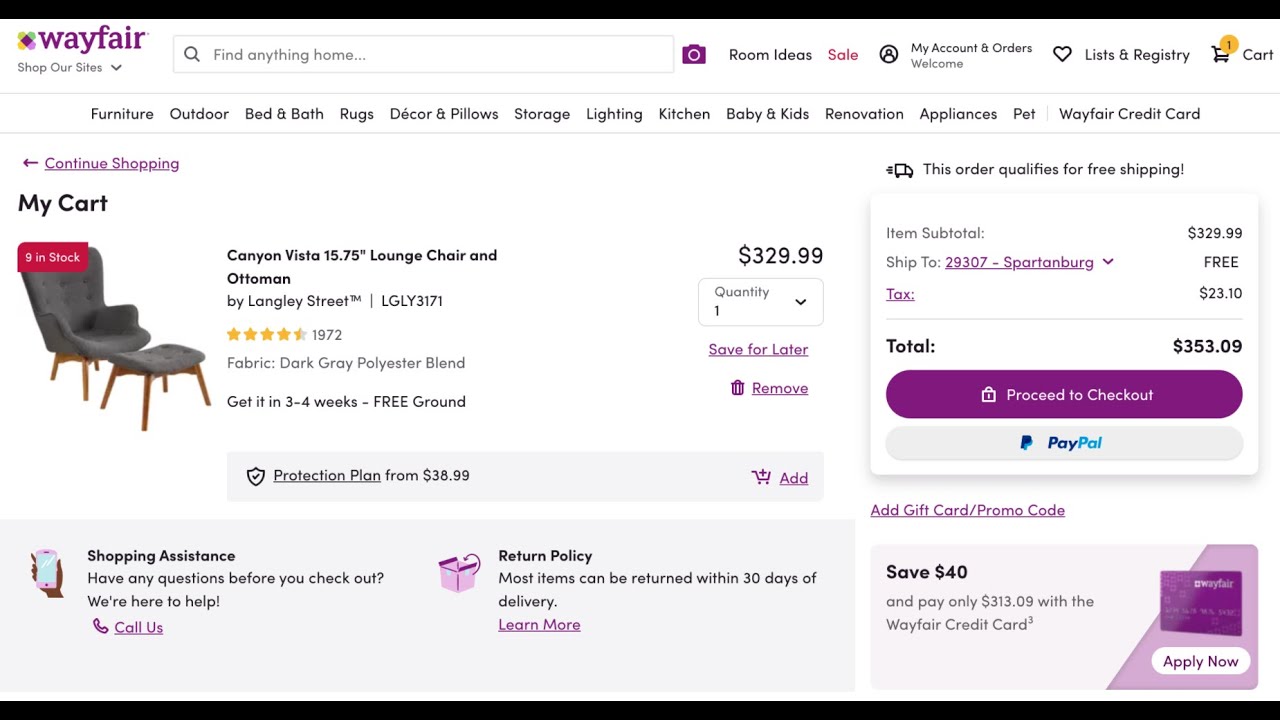

How do you pay on Wayfair?

Complete Your Wayfair Credit Card Payment by Phone

To make an immediate payment, call Wayfair credit services at 800-365-2714. You can access your account through the automated system using your account number or your Social Security number. Once you’ve accessed your account, follow the prompts to make your payment.

Does Wayfair use affirm?

Accepted Payment Methods:

Wayfair Financing (Affirm, Acima, Bread, Citizens Pay, Fortiva, Genesis, Katapult, Progressive Leasing). Learn more about our financing options.

Checkout with Wayfair using Katapult

Images related to the topicCheckout with Wayfair using Katapult

Is Wayfair a Comenity Bank?

Wayfair has ushered in two new credit cards, as the original Comenity Bank-issued card retired late last week. Launched in partnership with Citi on Sept.

Does Wayfair have klarna?

Wayfair is the latest edition to Klarna’s portfolio of clients that can now offer the bank’s ‘pay later’ service. Under the new partnership, customers using Wayfair.co.uk and Wayfair.de can now use Klarna to pay for products from one of the largest homeware retailers in the world.

Does Wayfair offer progressive leasing?

Wayfair adds Progressive Leasing option for customers – Furniture Today.

Does AfterPay run your credit?

AfterPay is a digital payment platform offered to online shoppers that allows them to delay payments on purchases. Users can make weekly payments on items purchased until they are paid in full. No credit check is required to use AfterPay, and no interest is charged.

What’s the minimum credit score for Affirm?

What credit score do I need to qualify for an Affirm loan? You need to have a credit score of at least 550 to qualify for an Affirm loan. But other factors like income, employment and your debt-to-income ratio (DTI) can also affect loan applications.

Does AfterPay affect your credit score?

It’s unlikely that using Afterpay will affect your credit score. Afterpay doesn’t perform a hard credit inquiry, which can lower your score, and it doesn’t report missed payments to the credit bureaus for most borrowers.

Does katapult affect credit?

Getting pre-approved for a Katapult lease purchase agreement does NOT affect your credit score!

How do you use Wayfair katapult?

Katapult offers a 90-day early purchase option as the most cost-effective path to ownership. Purchase your Wayfair lease in the first 90 days for just the cash price plus 5%, $45* initial payment, and any applicable taxes and fees. No early payment penalties, just early payment options.

Can you cancel Wayfair credit card?

Cancelling a Wayfair Credit Card

You can cancel your Wayfair Credit Card at any time by calling Citi at +1 800-365-2714. By no longer participating, you won’t earn any new rewards, and will lose any existing rewards associated with the Account.

Why did Comenity closed my account?

The reason given for account closure is “Number of recent inquiries on your credit report” and they pulled Experian. Given the same thing happened to me a year ago, when they closed my new IKEA card after around 45 days, while kept my old Overstock card, I think we have a solid data point here.

$3,000 Wayfair Master Credit Card To Build Credit! Soft Pull Prequalification!

Images related to the topic$3,000 Wayfair Master Credit Card To Build Credit! Soft Pull Prequalification!

Does Comenity Bank close accounts?

A Comenity Bank credit card closure due to inactivity isn’t out of the ordinary, but it’s hard to say how long it will take. Most card issuers will close an inactive credit account if the credit card doesn’t have an annual fee, and they have the right to do it.

What bank is overstock credit card through?

Overstock, in partnership with Comenity Capital Bank, is proud to offer you the Overstock Store Credit Card. This card is exclusive to use on Overstock.com purchases and provides special financing options for up to 24 months!

Related searches to Does Wayfair check your credit?

- citizens pay wayfair

- does wayfair financing check credit

- wayfair financing reviews

- does wayfair do a hard credit check

- does wayfair report to credit bureaus

- wayfair payment phone number

- wayfair credit card

- wayfair mastercard

- does wayfair accept klarna

- wayfair account online

- does wayfair check your credit

- wayfair payment options

- does wayfair accept checks

- does wayfair accept afterpay

- does wayfair affect your credit

Information related to the topic Does Wayfair check your credit?

Here are the search results of the thread Does Wayfair check your credit? from Bing. You can read more if you want.

You have just come across an article on the topic Does Wayfair check your credit?. If you found this article useful, please share it. Thank you very much.