Are you looking for an answer to the topic “How companies manipulate cash flow statement?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

Receivables increase cash flow, while accounts payable decrease cash flow. A company could artificially inflate its cash flow by accelerating the recognition of funds coming in and delay the recognition of funds leaving until the next period. This is similar to delaying the recognition of written checks.Typically, the majority of a company’s cash inflows are from customers, lenders (such as banks or bondholders), and investors who purchase equity from the company. Occasionally, cash flows come from legal settlements or the sale of company real estate or equipment.

- Use a Monthly Business Budget.

- Access a Line of Credit.

- Invoice Promptly to Reduce Days Sales Outstanding.

- Stretch Out Payables.

- Reduce Expenses.

- Raise Prices.

- Upsell and Cross-sell.

- Accept Credit Cards.

- Recording Revenue Prematurely or of Questionable Quality. …

- Recording Fictitious Revenue. …

- Increasing Income with One-Time Gains. …

- Shifting Current Expenses to an Earlier or Later Period. …

- Failing to Record or Improperly Reducing Liabilities.

- Negotiate quick payment terms. After you make a big sale, it can feel like the job is done. …

- Give customers incentives and penalties. …

- Check your accounts payable terms. …

- Cut unnecessary spending. …

- Consider leasing instead of buying. …

- Study your cash flow patterns. …

- Maintain a cash flow forecast. …

- Consider invoice factoring.

Table of Contents

How do companies solve cash flow problems?

- Use a Monthly Business Budget.

- Access a Line of Credit.

- Invoice Promptly to Reduce Days Sales Outstanding.

- Stretch Out Payables.

- Reduce Expenses.

- Raise Prices.

- Upsell and Cross-sell.

- Accept Credit Cards.

How do you manipulate financial statements?

- Recording Revenue Prematurely or of Questionable Quality. …

- Recording Fictitious Revenue. …

- Increasing Income with One-Time Gains. …

- Shifting Current Expenses to an Earlier or Later Period. …

- Failing to Record or Improperly Reducing Liabilities.

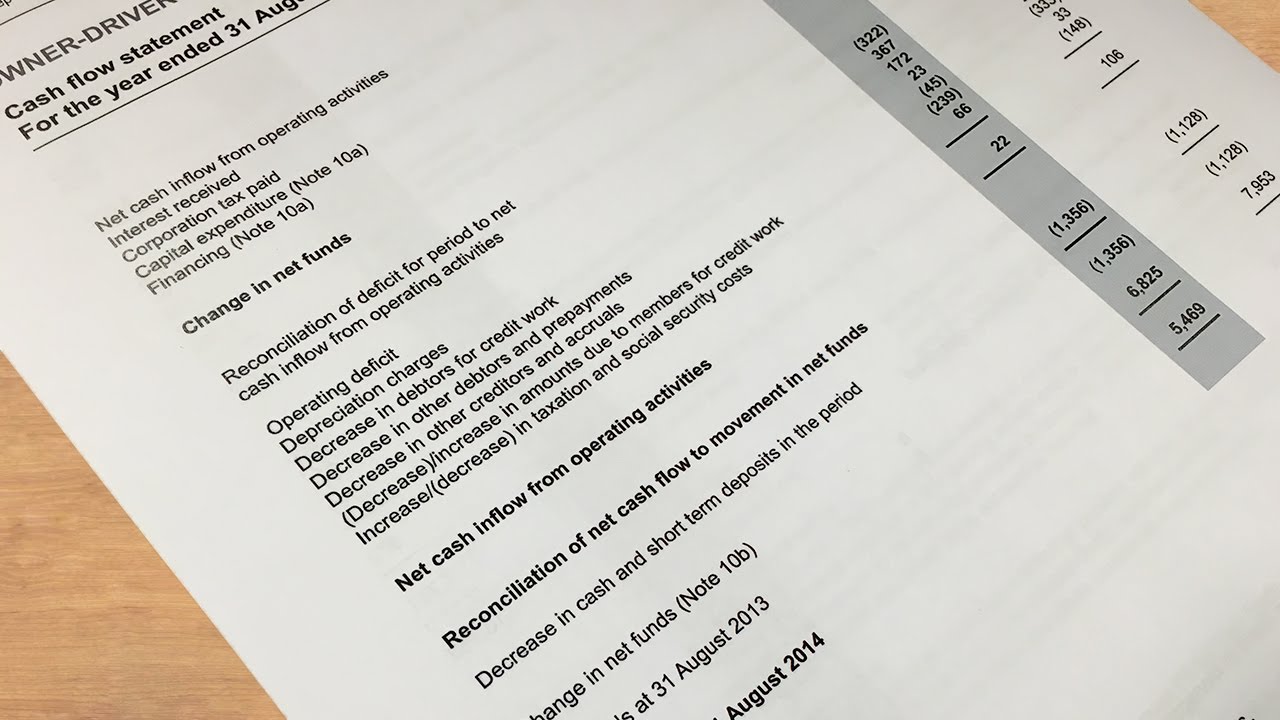

How Companies Manipulate Cash Flow

Images related to the topicHow Companies Manipulate Cash Flow

How do companies generate cash flow?

Typically, the majority of a company’s cash inflows are from customers, lenders (such as banks or bondholders), and investors who purchase equity from the company. Occasionally, cash flows come from legal settlements or the sale of company real estate or equipment.

Which strategies can your company use to improve cash flow?

- Negotiate quick payment terms. After you make a big sale, it can feel like the job is done. …

- Give customers incentives and penalties. …

- Check your accounts payable terms. …

- Cut unnecessary spending. …

- Consider leasing instead of buying. …

- Study your cash flow patterns. …

- Maintain a cash flow forecast. …

- Consider invoice factoring.

How do you know if a company has cash flow problems?

- Invoices are piling up. Businesses can’t expect to have any cash if their clients aren’t paying their bills. But, that’s the reality that many businesses face. …

- Expenses are increasing. Prices go up. Such is life. …

- Sales are slowing. Maybe, it’s a seasonal thing.

What are some practices that a business can adopt to help with cash flow issues?

- Adjust Your Business Plan to Improve Profit Margins. …

- Accelerate Your Receivables. …

- Negotiate Your Payables. …

- Consider Borrowing Options. …

- Raise Investor Capital. …

- Slash Expenses. …

- Sell Non-Essential Assets.

What is the most common technique used to manipulate financial statements?

The most common way of fudging financial statements is by creating provisions and reserves. Here the companies take advantage of the flexibility given by the accounting standards. The standards allow management to estimate and make assumptions for future bad debts, receivables, and other accrued income.

See some more details on the topic How companies manipulate cash flow statement? here:

Cash Flow on Steroids: Why Companies Cheat – Investopedia

Companies can bulk up their statements simply by changing the way they deal with the accounting recognition of their outstanding payments, or their accounts …

How Companies Manipulate Cash Flow from Operating …

A company may increase the sales by extending the credit to customers but it impacts the working capital position of the company as cash would …

Cash Flow Statement is the least manipulated Financial …

However, while the cash flow statement does render more transparency, it too can be manipulated to a certain degree. And with analysts …

Six Different Checks To Spot Cash Flow Manipulation

The tactics to manipulate cash flow is not reserved for just the Financing Section of the Statement of Cash Flows. Another clever hunting ground …

What is the example of manipulation of accounts?

There are many cases of financial manipulation that date back over the centuries, and modern-day examples such as Enron, Worldcom, Tyco International, Adelphia, Global Crossing, Cendant, Freddie Mac, and AIG should remind investors of the potential landmines that they may encounter.

Why do companies lie in accounting books?

To prevent companies from misrepresent any information’s to the investors. To prevent companies from using flexibility measures as it gives accountants to different methods for valuation of their assets.

What are the 4 types of cash flows?

- Cash Flows From Operations (CFO)

- Cash Flows From Investing (CFI)

- Cash Flows From Financing (CFF)

- Debt Service Coverage Ratio (DSCR)

- Free Cash Flow (FCF)

- Unlevered Free Cash Flow (UFCF)

How do you determine a company’s cash flow?

Use the cash flow statement and balance sheet to obtain cash flow from operations by adding net income, depreciation and amortization together with income from other sources or charges, then subtract the net increase in working capital (current assets minus current liabilities).

What are the 3 types of cash flows?

There are three cash flow types that companies should track and analyze to determine the liquidity and solvency of the business: cash flow from operating activities, cash flow from investing activities and cash flow from financing activities. All three are included on a company’s cash flow statement.

Is It Possible to Manipulate the Cash Flow Statement Part01

Images related to the topicIs It Possible to Manipulate the Cash Flow Statement Part01

How can a company speed up cash flow?

- Reduce your spending. Decreasing your spending is one of the more obvious ways to increase your cash flow. …

- Create additional revenue streams. …

- Offer discounts for fast payments. …

- Watch your inventory. …

- Consider raising your prices. …

- Offer prepayment rewards.

How do you keep cash flow positive?

- Get a deposit and establish milestones for long-term projects. …

- Consider a discount for immediate payment. …

- Raise your prices. …

- Offer premium or bundled services. …

- Create seasonal excitement. …

- Negotiate terms with vendors. …

- Implement systems that improve productivity.

How do you manage cash flow activities?

- Stay on top of bookkeeping. …

- Generate cash flow statements. …

- Analyze your cash flow. …

- Figure out whether you need to increase cash flow. …

- Cut spending where you need to. …

- Speed up your accounts receivable. …

- Rinse and repeat.

What are the most common causes of cash flow problems?

- Not Paying Attention to Expenses. …

- Uncertainty about Future Cash Flow. …

- Slow-paying Customers. …

- No Plan for Collections.

Which companies have cash flow problems?

Service providers: plumbers, lawn care providers, construction companies, designers, writers — pretty much anyone who provides a non-tangible in exchange for payment runs the risk of running into cash flow problems.

Why is my cash flow statement not balancing?

A cash flow statement is just a report, not a reconciliation. So if the closing bank balance doesn’t match the cash flow statement, something has gone wrong with the cash flow statement. To figure out where you went wrong, it is all about working backwards.

What are the five techniques in cash management?

- Create a cash flow statement and analyze it monthly. …

- Create a history of your cash flow. …

- Forecast your cash flow needs. …

- Implement ideas to improve cash flow. …

- Manage your growth.

How can a company save the financial crisis?

- Don’t go it alone. …

- Learn from other business owners. …

- Fine-tune your budget and optimize for cash flow. …

- Negotiate with creditors. …

- Reevaluate your business plan. …

- Make difficult choices. …

- Communicate with stakeholders.

How can cash flow problems be avoided?

- Make regular cash flow forecasts.

- Analyse your customers’ creditworthiness.

- Manage unpaid invoices to limit bad debts.

- Get ahead of customer insolvency.

What is accounting manipulation?

Accounting manipulation is defined as when the managers of an organization intentionally misstate their financial information to favorably represent the entity’s financial performance.

Five ways companies can cook cash flow – MoneyWeek Investment Tutorials

Images related to the topicFive ways companies can cook cash flow – MoneyWeek Investment Tutorials

How can financial statement manipulation be avoided?

- Segregate Duties. …

- Implement a Reconciliation Process. …

- Use an External Auditor. …

- Provide Board of Directors Oversight. …

- Review Inventory, Journal Entries, and Electronic Transfers. …

- Set a Strong Tone at the Top. …

- Set Up a Fraud Hotline.

How can financial statements be misleading?

Financial statement fraud is accomplished by improper revenue recognition, manipulation of expenses, non-recognition of liabilities and improper cash flow presentation. Misstated financial statements can lead to wrong business decisions.

Related searches to How companies manipulate cash flow statement?

- how is the statement of cash flows connected to the balance sheet

- where on the statement of cash flows would the sale of a building be classified?

- how is the statement of cash flows connected to the balance sheet?

- how companies manipulate cash flow statement

- cash flow statement tricks

- how are transfers between cash and cash equivalents treated on a statement of cash flows

- how to manipulate cash flow statement

- cash flows may be distorted by the transfers of receivables because companies may

- cash flow from operations formula

- cash flow statement indirect method solved examples

- where on the statement of cash flows would the sale of a building be classified

- how are transfers between cash and cash equivalents treated on a statement of cash flows?

- how do companies manipulate cash flows

- can cash flow statement be manipulated

- indirect method cash flow

- can companies manipulate their statement of cash flows

- the statement of cash flows reports business activities on an accrual basis

Information related to the topic How companies manipulate cash flow statement?

Here are the search results of the thread How companies manipulate cash flow statement? from Bing. You can read more if you want.

You have just come across an article on the topic How companies manipulate cash flow statement?. If you found this article useful, please share it. Thank you very much.