Are you looking for an answer to the topic “How do BCG and GE matrix help a multi business organization?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

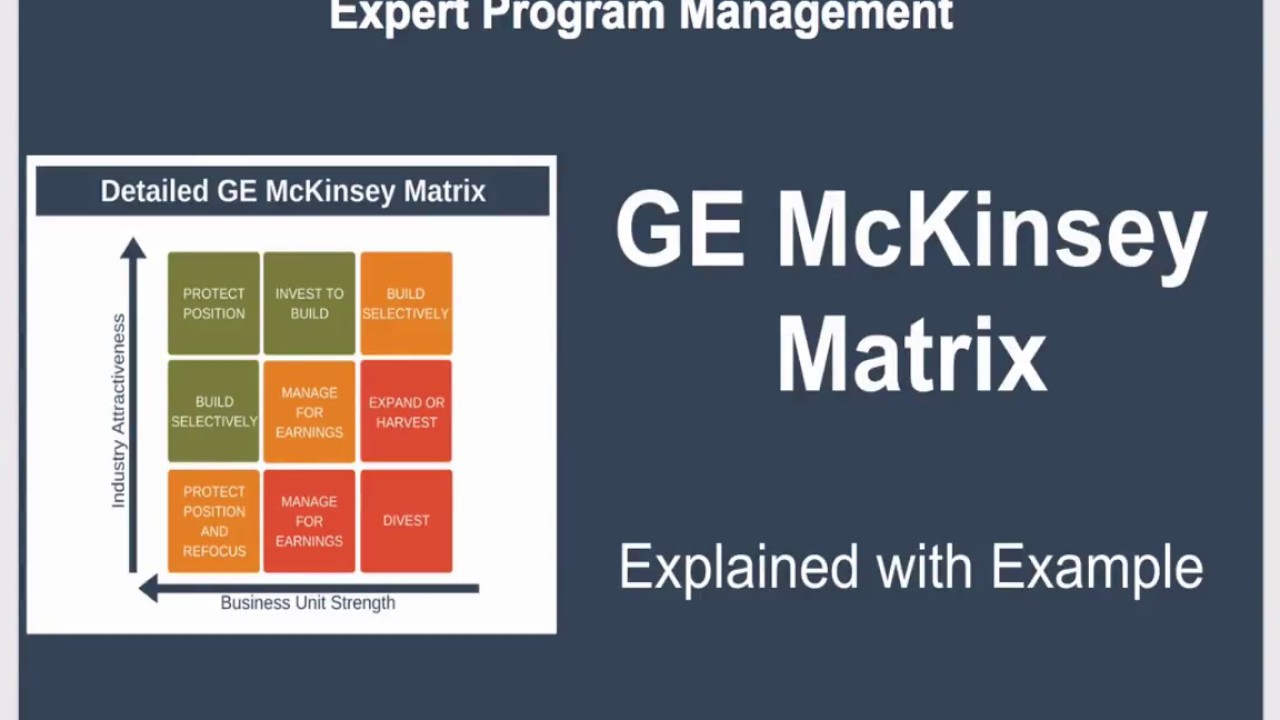

BCG matrix is used by the companies to deploy their resources among various business units. On the contrary, firms use GE matrix to prioritize investment among various business units. In BCG matrix only a single measure is used, whereas in GE matrix multiple measures are used.The Boston Consulting group’s product portfolio matrix (BCG matrix) is designed to help with long-term strategic planning, to help a business consider growth opportunities by reviewing its portfolio of products to decide where to invest, to discontinue, or develop products. It’s also known as the Growth/Share Matrix.The GE-McKinsey Matrix (a.k.a. GE Matrix, General Electric Matrix, Nine-box matrix) is a portfolio analysis tool used in corporate strategy to analyze strategic business units or product lines. This matrix combines two dimensions: industry attractiveness and the competitive strength of a business unit into a matrix.

Table of Contents

How does BCG matrix help a business or an industry?

The Boston Consulting group’s product portfolio matrix (BCG matrix) is designed to help with long-term strategic planning, to help a business consider growth opportunities by reviewing its portfolio of products to decide where to invest, to discontinue, or develop products. It’s also known as the Growth/Share Matrix.

What is the use of GE Matrix analysis for determining a business strategy?

The GE-McKinsey Matrix (a.k.a. GE Matrix, General Electric Matrix, Nine-box matrix) is a portfolio analysis tool used in corporate strategy to analyze strategic business units or product lines. This matrix combines two dimensions: industry attractiveness and the competitive strength of a business unit into a matrix.

BCG Matrix (Growth Market Share Matrix) | Hindi

Images related to the topicBCG Matrix (Growth Market Share Matrix) | Hindi

What value does the BCG matrix bring to an organization?

Understanding the Boston Consulting Group (BCG) Matrix

By using relative market share, it helps measure a company’s competitiveness. The vertical axis of the BCG Matrix represents the growth rate of a product and its potential to grow in a particular market.

How is BCG matrix useful in Analysing a company’s internal environment?

The main purpose of the BCG Matrix is therefore to make investment decisions on a corporate level. Depending on how well the unit and the industry is doing, four different category labels can be attributed to each unit: Dogs, Question Marks, Cash Cows and Stars.

How is GE matrix different from the BCG matrix?

BCG matrix is used by the companies to deploy their resources among various business units. On the contrary, firms use GE matrix to prioritize investment among various business units. In BCG matrix only a single measure is used, whereas in GE matrix multiple measures are used.

What are the advantages of BCG matrix?

The advantages of the Boston Matrix include: It provides a high-level way to see the opportunities for each product in your portfolio. It enables you to think about how to allocate your limited resources to the portfolio so that profit is maximized over the long-term. It shows if your portfolio is balanced.

What factors are used as the basis for analyzing business and brands using the BCG and the GE approaches?

The Boston Consulting Group (BCG) matrix helps companies evaluate each of its strategic business units based on two factors: (1) the SBU’s market growth rate (i.e., how fast the unit is growing compared to the industry in which it competes) and (2) the SBU’s relative market share (i.e., how the unit’s share of the …

See some more details on the topic How do BCG and GE matrix help a multi business organization? here:

BCG Matrix & GE Matrix | Mba Mart

The BCG Matrix helps a company with multiple business units/products by determining the strengths of each business unit/product and the …

GE McKinsey Matrix: The Ultimate Guide – Strategic …

The GE-McKinsey matrix is an important tool for managing a product portfolio. We show you its value in making investment choices.

GE McKinsey Matrix EXPLAINED with EXAMPLES | B2U

The GE-McKinsey Matrix (a.k.a. GE Matrix, General Electric Matrix, Nine-box matrix) is just like the BCG Matrix a portfolio analysis tool …

Marketing Theories – GE Matrix – Professional Academy

The GE matrix was developed by Mckinsey and Company consultancy group in the 1970s. The nine cell grid measures business unit strength against industry …

What is BCG matrix in strategic management?

The BCG growth-share matrix is a tool used internally by management to assess the current state of value of a firm’s units or product lines. The growth-share matrix aids the company in deciding which products or units to either keep, sell, or invest more in.

Is a strategy tool that offers a systematic approach for the multi business corporation to prioritize its investments among its business units?

Detailed Solution. The G. E. Business Model as known as the McKinsey Matrix is defined as, “The GE-McKinsey nine-box matrix is a strategy tool that offers a systematic approach for the multi-business corporation to prioritize its investments among its business units”.

How can a company use the BCG matrix?

To use the BCG matrix, a company will review its portfolio of products or SBUs, then allocate them to one of four quadrants based on their market share, growth rate, cash generation and cash usage. This is then used to determine which products receive investment, and which are diversified from.

What is BCG matrix What are its uses and limitations?

It is the most renowned corporate portfolio analysis tool. It provides a graphic representation for an organization to examine different businesses in it’s portfolio on the basis of their related market share and industry growth rates. It is a two dimensional analysis on management of SBU’s (Strategic Business Units).

BCG Matrix (Growth-Share Matrix) EXPLAINED | B2U | Business To You

Images related to the topicBCG Matrix (Growth-Share Matrix) EXPLAINED | B2U | Business To You

What are the advantages and disadvantages of BCG matrix?

Benefits of the BCG-Matrix: The BCG-Matrix is helpful for managers to evaluate balance in the companies’s current portfolio of Stars, Cash Cows, Question Marks and Dogs. BCG-Matrix is applicable to large companies that seek volume and experience effects. The model is simple and easy to understand.

Is the BCG matrix still relevant today?

The matrix remains relevant today—but with some important tweaks. A Changing Business Environment Since the introduction of the matrix, conglomerates have become less common and the business environment has become more dynamic and unpredictable.

What two components of a business product or business unit does the BCG matrix address?

These high growth rates then signal which markets have the most growth potential. The matrix reveals two factors that companies should consider when deciding where to invest—company competitiveness, and market attractiveness—with relative market share and growth rate as the underlying drivers of these factors.

What companies use the BCG matrix?

- BCG Matrix of Coca-Cola. …

- BCG Matrix of Samsung. …

- BCG Matrix of L’Oréal. …

- BCG Matrix of PepsiCo. …

- BCG Matrix of Apple. …

- BCG Matrix of Nestle. …

- BCG Matrix of Unilever. …

- BCG Matrix of McDonalds.

What is the advantage of GE nine cell over the BCG matrix?

The advantages of GE Matrix are: It provides a method to establish which activities in a business should get investment. It is a simple tool to show the whole business portfolio in one image. It is more detailed than alternatives such as the BCG Matrix.

What is the essence of GE Matrix?

The GE matrix helps a strategic business unit evaluate its overall strength. Each product, brand, service, or potential product is mapped in this industry attractiveness/business strength space. The GE multi factorial was first developed by McKinsey for General Electric in the 1970s.

Why GE matrix is superior to BCG matrix?

BCG Matrix. The main advantage of the GE Matrix as a strategy tool is, of course, that it tries to answer the question of where scarce resources should be invested. It is more refined than the BCG Matrix as it replaces a single factor, “market growth,” with many factors under “market attractiveness.”

How BCG can help in improve your business performance?

The Boston Consulting Group’s growth share matrix (commonly referred to as the BCG matrix) is a business tool that reviews a company’s product portfolio or SBUs (strategic business units) to help them decide in what to invest, what to discontinue, and which products to develop further.

What two metrics are used in the BCG portfolio analysis to evaluate the various products of a firm?

What two metrics are used in the BCG portfolio analysis to evaluate the various products of a firm? -According to the market/product and services strategies matrix, by definition, firms that exploit growth opportunities for new products in current markets are engaged in product development.

GE McKinsey Matrix | McKinsey Model | GE Matrix

Images related to the topicGE McKinsey Matrix | McKinsey Model | GE Matrix

What is Boston Matrix in marketing?

The Boston Matrix is a model which helps businesses analyse their portfolio of businesses and brands. The Boston Matrix is a popular tool used in marketing and business strategy. A business with a range of products has a portfolio of products. However, owning a product portfolio poses a problem for a business.

Which model consider industry attractiveness and business strength as the basis for classifying the firms?

(ii) GE Matrix: Industry attractiveness Vs Business Strength or Competitive position.

Related searches to How do BCG and GE matrix help a multi business organization?

- bcg matrix in strategic management

- ge matrix of nestle

- ge matrix in strategic management

- ge multifactor portfolio matrix

- ge mckinsey matrix

- ge matrix example

- how do bcg and ge matrix help a multi business organization

- ge nine cell matrix

- ge mckinsey matrix pdf

Information related to the topic How do BCG and GE matrix help a multi business organization?

Here are the search results of the thread How do BCG and GE matrix help a multi business organization? from Bing. You can read more if you want.

You have just come across an article on the topic How do BCG and GE matrix help a multi business organization?. If you found this article useful, please share it. Thank you very much.