Are you looking for an answer to the topic “How do changes in the reserve requirement affect the money multiplier?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

The size of the multiplier depends on the percentage of deposits that banks are required to hold as reserves. When the reserve requirement decreases, the money supply reserve multiplier increases and vice versa.An increase in reserve requirements means that banks must hold more reserves and therefore loan less. As a result an increase in the reserve requirements raises the reserve ratio, lowers the money multiplier, and decreases the money supply.Reserve Requirement Changes Affect the Money Stock

Increasing the (reserve requirement) ratios reduces the volume of deposits that can be supported by a given level of reserves and, in the absence of other actions, reduces the money stock and raises the cost of credit.

Table of Contents

How do changes in the reserve requirement affect the money multiplier quizlet?

An increase in reserve requirements means that banks must hold more reserves and therefore loan less. As a result an increase in the reserve requirements raises the reserve ratio, lowers the money multiplier, and decreases the money supply.

What does a change in reserve requirements affect?

Reserve Requirement Changes Affect the Money Stock

Increasing the (reserve requirement) ratios reduces the volume of deposits that can be supported by a given level of reserves and, in the absence of other actions, reduces the money stock and raises the cost of credit.

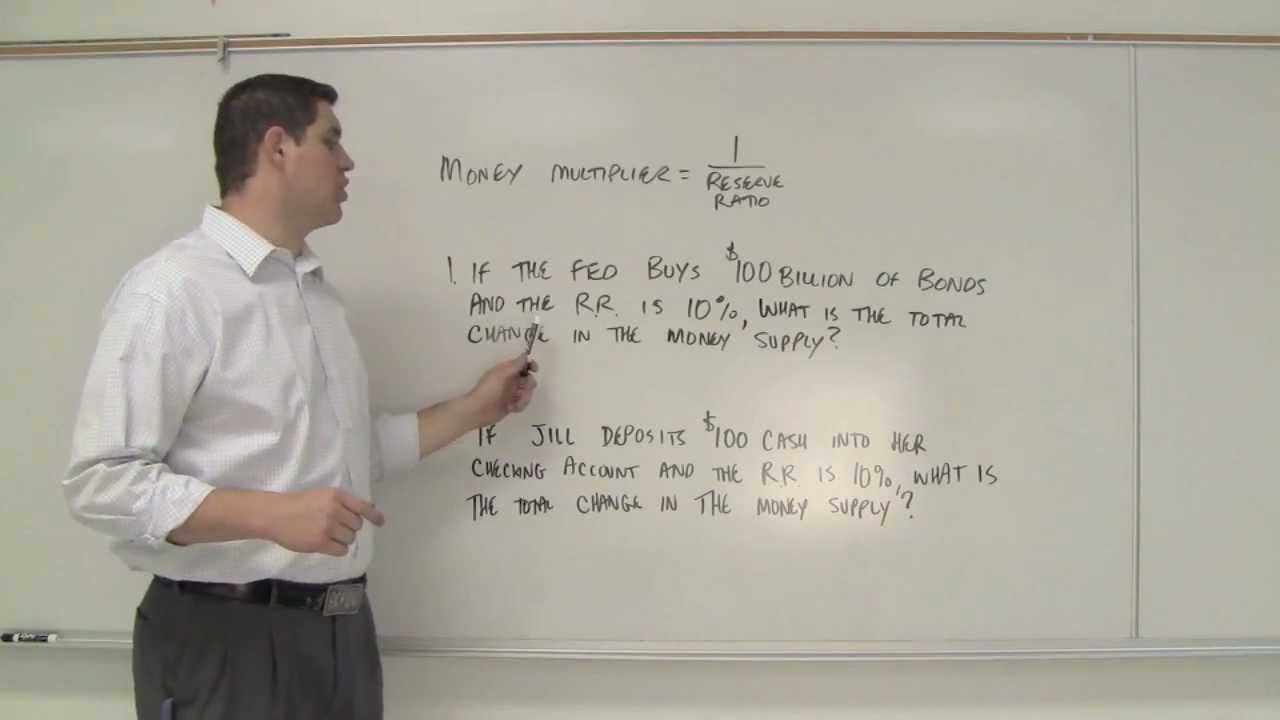

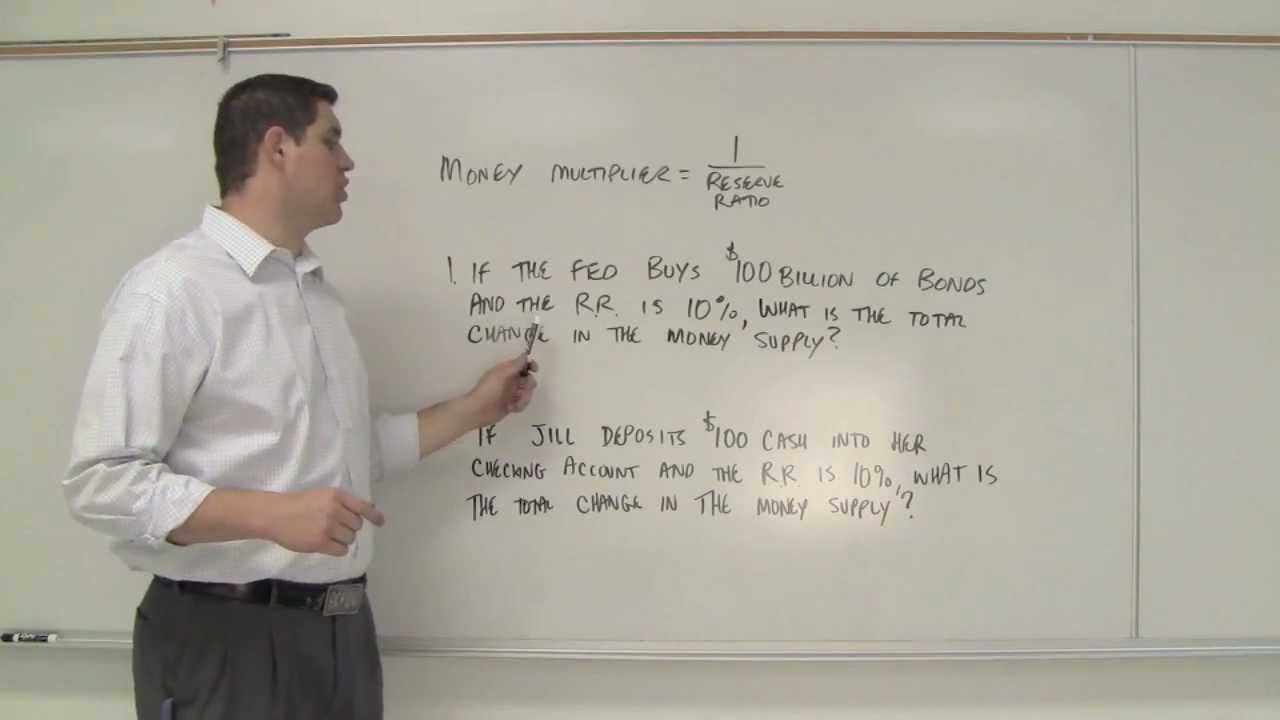

The Money Multiplier and Reserve Requirement

Images related to the topicThe Money Multiplier and Reserve Requirement

What happens when the reserve requirement is increased?

By increasing the reserve requirement, the Federal Reserve is essentially taking money out of the money supply and increasing the cost of credit. Lowering the reserve requirement pumps money into the economy by giving banks excess reserves, which promotes the expansion of bank credit and lowers rates.

Does increasing the reserve requirement decrease the money multiplier?

In a system with fractional reserve requirements, an increase in bank reserves can support a multiple expansion of deposits, and a decrease can result in a multiple contraction of deposits. The value of the multiplier depends on the required reserve ratio on deposits.

What is money multiplier effect?

The money-multiplier process explains how an increase in the monetary base causes the money supply to increase by a multiplied amount. For example, suppose that the Federal Reserve carries out an open-market operation, by creating $100 to buy $100 of Treasury securities from a bank. The monetary base rises by $100.

When the reserve requirement is lowered what happens quizlet?

If the Fed lowers the reserve requirements what will happen? A portion of what was previously required reserves becomes excess reserves, which can be used to make loans and expand money supply. A lower reserve requirement also increases the deposit expansion multiplier.

What happens to the money multiplier when the reserve ratio increases?

Higher the required reserve ratio, lesser the excess reserves, lesser the banks can lend as loans, and lower the money multiplier. Lower the required reserve ratio, higher the excess reserves, more the banks can lend, and higher is the money multiplier.

See some more details on the topic How do changes in the reserve requirement affect the money multiplier? here:

What effect does a change in the reserve requirement ratio …

Reserve Requirement Changes Affect the Money Stock Decreasing the ratios leaves depositories initially with excess reserves, which can induce an expansion of …

Lesson summary: banking and the expansion of the money …

When a bank makes loans out of excess reserves, the money supply increases. We can predict the maximum change in the money supply with the money multiplier.

How the Reserve Ratio Affects the Money Supply – Study.com

That means changes in the reserve ratio will change the multiplier effect, and that changes the money supply.

Money Supply – Econlib

The value of the multiplier depends on the required reserve ratio on deposits. A high required-reserve ratio lowers the value of the multiplier. A low required- …

How does reserve requirement affect money supply?

The Fed can influence the money supply by modifying reserve requirements, which generally refers to the amount of funds banks must hold against deposits in bank accounts. By lowering the reserve requirements, banks are able to loan more money, which increases the overall supply of money in the economy.

What happens when the reserve requirement is decreased?

When the Federal Reserve decreases the reserve ratio, it lowers the amount of cash that banks are required to hold in reserves, allowing them to make more loans to consumers and businesses. This increases the nation’s money supply and expands the economy.

When the Fed increases reserve requirements it reduces the money supply by causing?

When the Fed increases reserve requirements, it reduces the money supply by causing: the money multiplier to fall. When the zero-lower-bound problem occurs, central banks can rely on: the liquidity provision.

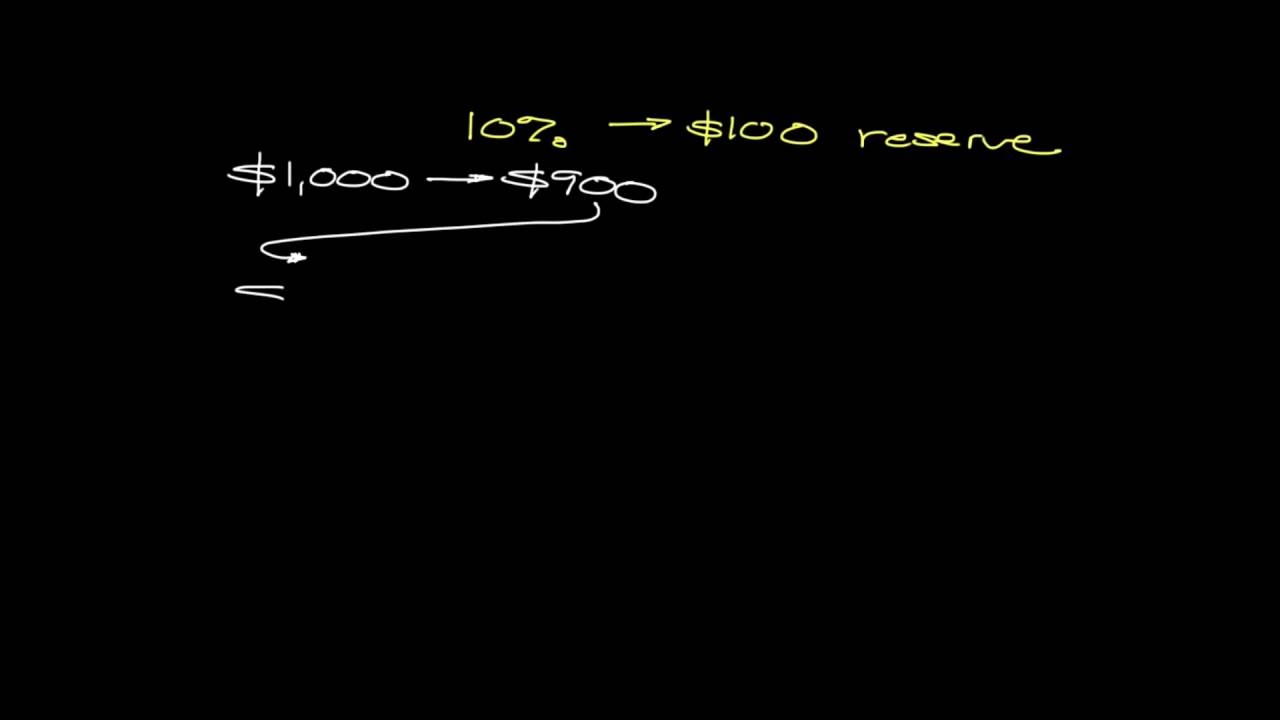

The Money Multiplier

Images related to the topicThe Money Multiplier

When reserve requirements are increased the quizlet?

What happens when reserve requirements are increased? Banks must hold more reserves so they can loan out less of each dollar that is deposited. Raises the reserve ratio, lowers the money multiplier, and decreases the money supply.

How does reserve requirement affects bank liquidity?

Raising the reserve requirement reduces the amount of money that banks have available to lend. Since the supply of money is lower, banks can charge more to lend it. That sends interest rates up. Changing the requirement is expensive for banks.

How do the money multiplier and money supply change if the required reserve ratio decreases?

The size of the multiplier depends on the percentage of deposits that banks are required to hold as reserves. When the reserve requirement decreases, the money supply reserve multiplier increases and vice versa.

How would an increase in the required reserve ratio affect borrowers?

How would an increase in the required reserve ratio affect borrowers? It would force banks to recall a significant number of loans, which would hurt many borrowers.

When the reserve requirement is increased the excess reserves of member banks are?

When the reserve requirement is increased: the excess reserves of member banks are reduced. 30 percent, the banking system then has: neither an excess nor a deficiency of reserves.

What factors affect the money multiplier?

The factors affecting the money multiplier are excess reserves ratio, currency ratio, and required reserves ratio. You can read about the Money Supply in Economy – Types of Money, Monetary Aggregates, Money Supply Control in the given link.

What decreases the money multiplier?

Like banks keeping excess reserves, this limits the created money supply and the resulting money multiplier figure. Similarly, conversions of checkable deposits to currency reduces the money multiplier by taking away some amount of deposits and reserves from the system.

Which of the following would reduce the money multiplier?

If the monetary authorities want to reduce the monetary multiplier, they should: raise the required reserve ratio. Suppose that a bank’s actual reserves are $5 million, its checkable deposits are $5 million, and its excess reserves are $3 million.

What happens to the money multiplier when the reserve requirement increases from 20% to 25 %?

It increased from 8.3 to 10. What happens to the money multiplier when the reserve requirement increases from 20% to 25%? It decreases from 5 to 4.

Reserve Requirements Explained

Images related to the topicReserve Requirements Explained

How do reserve requirements work quizlet?

Reserve requirements are regulations on the minimum amount of reserves that banks must hold against deposits. An increase in reserve requirements raises the reserve ratio, lowers the money multiplier, and decreases the money supply.

What causes an increase in the money multiplier?

An increase in a cash reserve ratio prevents the banks from lending more money and reduces the money multiplier. An increase in the banking habit of the population will increase the lending, thereby will lead to more deposits in the banking system, hence increasing the money multiplier.

Related searches to How do changes in the reserve requirement affect the money multiplier?

- money multiplier effect

- how do changes in the reserve requirement affect the money multiplier

- money multiplier formula

- required reserve ratio

- money multiplier example

- how do changes in the reserve requirement affect the money multiplier chegg

- money supply formula

- what happens when the reserve requirement is decreased

- money multiplier calculator

Information related to the topic How do changes in the reserve requirement affect the money multiplier?

Here are the search results of the thread How do changes in the reserve requirement affect the money multiplier? from Bing. You can read more if you want.

You have just come across an article on the topic How do changes in the reserve requirement affect the money multiplier?. If you found this article useful, please share it. Thank you very much.