Are you looking for an answer to the topic “How do I create a BIR Form 2307?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

Keep Reading

Table of Contents

How do I create a form 2307?

- Click the excel icon to choose the excel template to be used.

- Click BIR Form 2307 to download the template. Open the template and take time to analyze the sample data. …

- Again, DO NOT edit Row1 and DO NOT work directly in the template.

What is BIR Form No 2307?

What is this form? BIR Form 2307, or Certificate of Creditable Tax Withheld at Source is a tax certificate which needs to be accomplished by the withholding agent which shows the recipient of any income subject to expanded withholding tax.

HOW TO FILL OUT BIR FORM 2307 | AS PRIVATE WITHHOLDING AGENT

Images related to the topicHOW TO FILL OUT BIR FORM 2307 | AS PRIVATE WITHHOLDING AGENT

How do I upload 2307?

You can enter the Certificates of Tax Withheld (Form 2307) that you received from your client by going to the Withheld Taxes view: Press ADD RECORD to add a new 2307 record. You enter the details as they appear in your Form 2307. Note also that you need to upload a clear scan/photo of the signed 2307.

Do I need to file 2307?

Since Form 2307 functions as income tax credits, it is imperative that the payee takes note of it when accomplishing Income Tax Returns as it is a legit proof of the withholding tax. Otherwise, you will not be permitted to claim your tax credit.

How do I calculate EWT for VAT registration?

- EWT= Income payments x tax rate. EWT= P20,000 x 5% …

- Documentary Requirements.

- Procedures.

- Filing Via EFPS.

- Payment Via EFPS. …

- Manual Filing and Payment. …

- Source:

How do I get a tax withholding certificate?

- Step 1: Visit iTax Portal Using https://itax.kra.go.ke/KRA-Portal/ …

- Step 2: Enter Your KRA PIN Number. …

- Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp) …

- Step 4: iTax Portal Account Dashboard. …

- Step 5: Click On Certificate Menu Tab. …

- Step 6: Click Consult To Reprint Withholding Certificate.

How do I calculate 2307 withholding?

With Creditable Withholding Tax (BIR FORM 2307) For collection of sales with credible withholding tax (BIR form 2307), computation of the amount to be collected is as follows: Determine the amount of gross sales; Determine the withholding tax rate applicable; Compute the amount of withholding tax by multiplying the …

See some more details on the topic How do I create a BIR Form 2307? here:

How to Generate BIR Form 2307 | bir-excel-uploader

Click BIR Form 2307 to download the template. Open the template and take time to analyze the sample data. Row1 is fixed, DO NOT edit or fomat Row1. In case you …

BIR Form 2307 – The What, When, and How – JuanTax

Tax Preparation form in which the certificate should be attached. Income Tax Returns, Expanded Withholding Tax (EWT), Percentage Tax, VAT Withholding.

How to Generate BIR form 2307 in Sprout Payroll

1. Go to Reports · 2. Click BIR · 3. Click 2307 · 4. Click the necessary details · 5. Print PDF file.

Certificates – Bureau of Internal Revenue

For Percentage Taxes on Government Money Payments – This Certificate is to be attached to the Quarterly Percentage Tax return (BIR Form No. 2551M and 2551Q).

What is the difference between BIR form 2306 and 2307?

BIR Form No. 2306 (Certificate of Final Tax Withheld at Source) shall no longer be issued for this purpose. The BIR Form 2307 shall be used by the VAT taxpayers as proof of claiming VAT credit in monthly and quarterly VAT declarations.

Who is the withholding agent?

A WITHHOLDING AGENT – is any person or entity who is in control of the payment subject to withholding tax and therefore is required to deduct and remit taxes withheld to the government. Compensation – is the tax withheld from income payments to individuals arising from an employer-employee relationship.

How do I convert Excel to Bir dat?

- Step 1Download BIR Form Excel FormatStep 2. = this. Page. …

- Step 2BIR Header File Information (Owner’s Info)Step 3. Tax ID and Other Details. …

- Step 3Generate BIR DAT File. = this. …

- Validate the DAT File. Before sending to [email protected] please validate the generated DAT File using the BIR Validation Module.

How do I attach an eBIRForms file online?

Download and install the latest eBIRForms Offline Package. Install the software and look for the eBIRForms icon on your computer (take note that you can only use. Enter important background details such as your TIN, RDO Code, etc. Then, select the type of BIR form you want to file and click “Fill Up”.

HOW TO FILE BIR 2307 (Complete simple step-by-step guide)

Images related to the topicHOW TO FILE BIR 2307 (Complete simple step-by-step guide)

How many percent is EWT?

| NATURE OF INCOME PAYMENT | TAX RATE | TAX RATE |

|---|---|---|

| EWT- professional/talent fees paid to juridical persons/individuals (lawyers, CPAs, etc.) | 10% | 10% |

| EWT- professional entertainers- – if the current year’s gross income does not exceed P720,000.00 | 10% | 10% |

| – if the current year’s gross income exceeds P720,000.00 | 20% | 10% |

Where do I get BIR exemption certificate?

Where To Get a Certificate of Tax Exemption? The Certificate of Tax Exemption (CTE) is obtained from the Revenue District Office (RDO) having jurisdiction over the residence of the taxpayer or where the taxpayer is registered.

Is withholding tax income tax?

Withholding tax is a set amount of income tax that an employer withholds from an employee’s paycheck and pays directly to the government in the employee’s name. The money taken is a credit against the employee’s annual income tax bill.

How much is the penalty for late payment in BIR?

| TAX CODE SEC | NATURE OF VIOLATION | CRIMINAL PENALTY IMPOSED |

|---|---|---|

| 255 | Failure to file and/or pay any internal revenue tax at the time or times required by law or regulation | Fine of not less than P10,000 and imprisonment of not less than one (1) year but not more than 10 years |

How do I calculate withholding tax on an invoice?

- The Base amount is taken to be the total for the Payment i.e. 100.00 + 1200.00 + 1500.00 = 2800.00.

- The Non Tax. …

- The Min. …

- The Calculation Formula specifies that Withholding Tax is 10%.

- 1800 * 10% = 180.00. …

- The Withholding Tax Amount is distributed to the Purchase Invoices proportionally:

What is EWT BIR?

The withholding tax system, specifically that of the creditable/expanded withholding tax or “EWT,” is a means of approximating and collecting in advance the income tax liability of a payee or income earner for certain types of income payments.

Is EWT and CWT the same?

Upon registration of their respective business entities, withholding tax type is a must and it may come in three (3) tax types as sub classifications as follows: Expanded withholding tax (EWT) or Creditable withholding tax (CWT) under monthly BIR Form No. 1601E and annual BIR Form No.

What is a withholding certificate?

A withholding certificate is an application for a reduced withholding based on the gain of a sale instead of the selling price. If 15% of the selling price is more than the tax you will owe on this sale, then a withholding certificate may be ideal for you.

How do I file withholding tax Philippines?

What forms are required for submitting withholding taxes? All TWAs are required to remit taxes monthly using BIR Form 0619E. The form must be submitted on the 10th calendar date after the month the tax has been withheld. EFPS users (i.e. those who pay their taxes online) can file up to the 15th of the month.

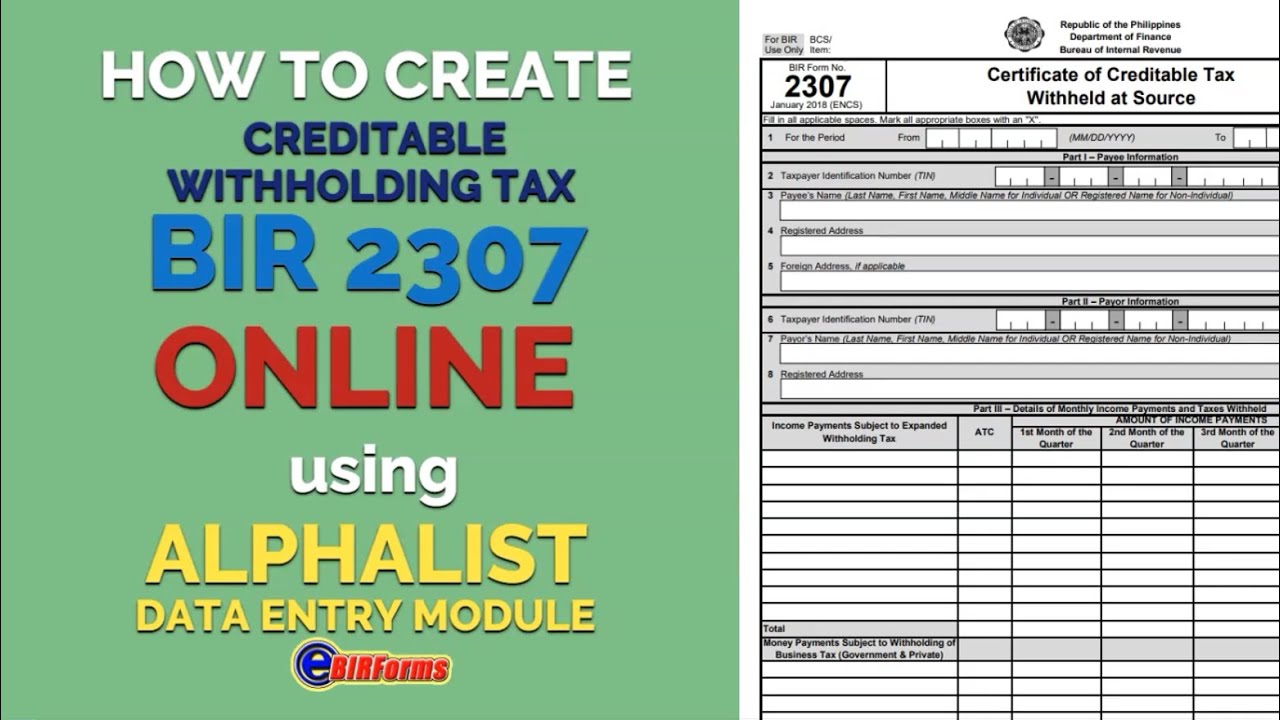

Paano gumawa ng BIR form 2307 online gamit ang Alphalist Data Entry Module ng eBirforms?

Images related to the topicPaano gumawa ng BIR form 2307 online gamit ang Alphalist Data Entry Module ng eBirforms?

How do I pay withholding tax?

- Step 1: Complete an IRS Form 941, Employer’s Quarterly Income Tax Return, or annually Form 943 for Agriculture Employees.

- Step 2: Calculate your Federal Unemployment Tax (FUTA) on Form 940.

- Step 3: Sign up for the Electronic Federal Tax Payment System (EFTPS)

How do I know how much tax I should pay?

- Choose the financial year for which you want your taxes to be calculated.

- Select your age accordingly. …

- Click on ‘Go to Next Step’

- Enter your taxable salary i.e. salary after deducting various exemptions such as HRA, LTA, standard deduction, and so on. (

Related searches to How do I create a BIR Form 2307?

- who should file bir form 2307

- how to fill up bir form 2307 online

- bir form 2306

- how to file bir form 2307

- certificate of creditable tax withheld at source

- who is the payee in bir form 2307

- how to print bir form 2307

- what to do with bir form 2307

- what is bir form no. 2307

- how is bir form 2307 calculated

- how do i create a bir form 2307

- 2307 deadline of submission 2022

- sample 2307 for rentals

- 2307 form excel

- how to get bir form 2307

- 2307 bir form download

Information related to the topic How do I create a BIR Form 2307?

Here are the search results of the thread How do I create a BIR Form 2307? from Bing. You can read more if you want.

You have just come across an article on the topic How do I create a BIR Form 2307?. If you found this article useful, please share it. Thank you very much.