Are you looking for an answer to the topic “How do I deduct absent days from salary?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

If any work is performed in a day, no deductions from salary are allowed. For example, if an employee is absent for one-and-a-half days, an employer may only deduct for one full day. Full-day deductions are allowed when leave is taken under the FMLA.Based on the above, there are two main calculation methods: one is deduction for absence, which means the portion of days absent is to be deducted from the monthly basic salary, i.e. salary of a given month = salary of the whole month – (daily salary × absent days); The other method is cumulative-based calculation, …For example: an employee earned $10,000 for December (which had 22 working days in that year) and took 2 days of unpaid leave. Then, the unpaid leave deduction per day = 10,000 / 22 = 454.5454.

Table of Contents

How do I deduct absent?

Based on the above, there are two main calculation methods: one is deduction for absence, which means the portion of days absent is to be deducted from the monthly basic salary, i.e. salary of a given month = salary of the whole month – (daily salary × absent days); The other method is cumulative-based calculation, …

How do you calculate unpaid days from salary?

For example: an employee earned $10,000 for December (which had 22 working days in that year) and took 2 days of unpaid leave. Then, the unpaid leave deduction per day = 10,000 / 22 = 454.5454.

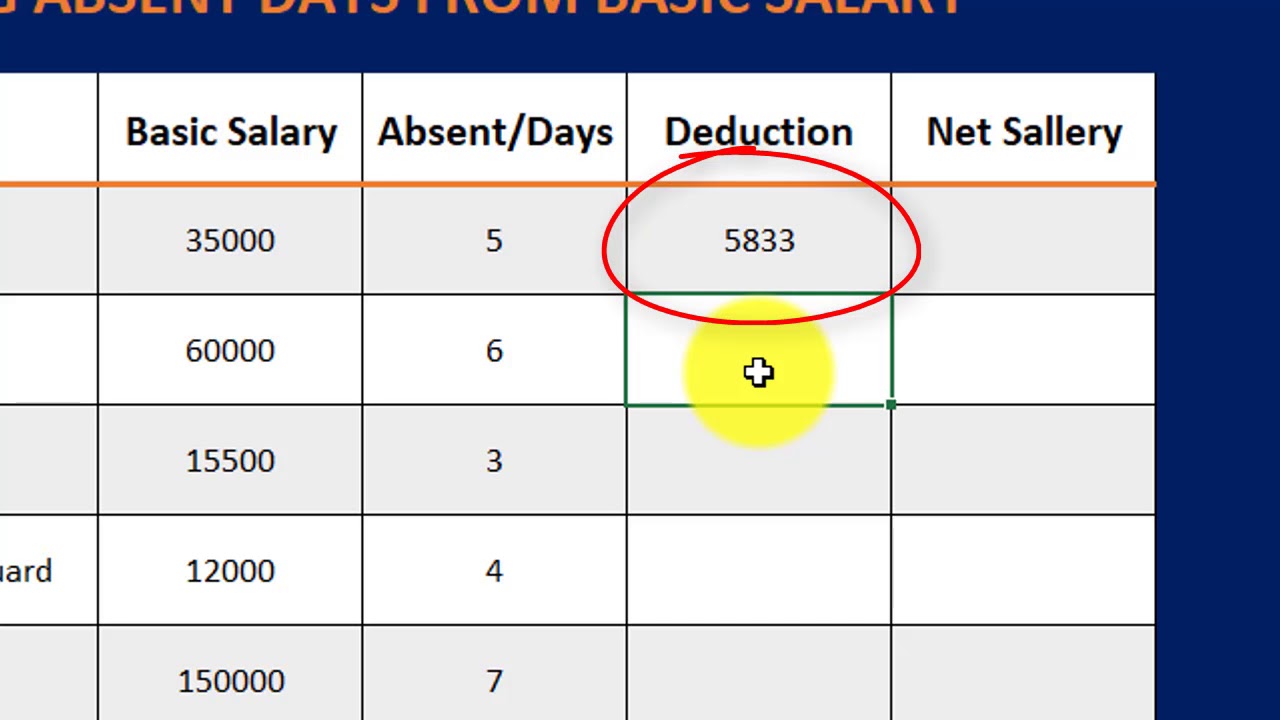

How to Deduct Absent days from basic salary in excel 2016 step by step

Images related to the topicHow to Deduct Absent days from basic salary in excel 2016 step by step

Can you deduct time from a salaried employee?

The short answer is “yes.” The rule of thumb under the Fair Labor Standards Act (“FLSA”) is that the regulations do not permit an employer to dock pay from a salaried, exempt employee. Doing so, can cause an entire class of employees to suddenly go from exempt to non-exempt and thus, entitled to overtime.

How do you calculate days into salary?

For example, if the total monthly salary of an employee is Rs 30,000, and if the employee joins an organization on September 21, the employee will be paid Rs 10,000 for the 10 days in September. Since September has 30 calendar days, the per-day pay is calculated as Rs 30,000/30 = Rs 1,000.

How do you write an email for salary deduction?

I am writing to you to lure your attention on an issue that I have been facing from last few months. As I get my salary on time but some deductions have been made from my salary which I haven’t been even informed. (Show your actual problem and situation). It happened many times with me in the last few months.

Is loss of pay deducted from basic salary?

salaries are being calculated on monthly basis and if any staff applied leave beyond his leave credit, Loss of pay is calculated on gross salary and is deducted from salary.

How many days unpaid leave is an employee entitled to?

Annual leave entitlement

The entitlement is 21 consecutive days annual leave on full remuneration, in respect of each annual leave cycle, and if an employee works a five-day week then this is equal to 15 working days, or if the employee works a six-day week then it is equal to 18 working days.

See some more details on the topic How do I deduct absent days from salary? here:

How to Calculate Unpaid Days From Salary – Small Business …

Convert the employee’s annual, monthly or weekly salary to a daily rate. Then deduct for each day they’re absent. Make certain first that they wanted the …

On Calculation of Monthly Salary in the Case of Absence

Based on the above, there are two main calculation methods: one is deduction for absence, which means the portion of days absent is to be …

How to deduct absent days amount from monthly salary

6 Answers … Hi, You need to set-up Leave of Absences, then only you can apply any absences. … elements.Thisisthe case when your absence elements are non- …

make deductions from an exempt employee’s pay – elaws …

If an exempt employee is absent for one and one-half days for personal reasons, the employer may only deduct for the one full-day absence. The exempt employee …

What are the deductions from salary in Philippines?

Employers in the Philippines are required to deduct contributions from employee salaries and remit to the Pag-ibig Fund on behalf of their employees. For those earning a gross income of P1,500 and below monthly, Pag-ibig contributions are 1% of basic salary for employees and 2% for the employer.

What does unpaid leave mean on payslip?

Unpaid leave is where an employee takes time off from their job without pay. In some situations, as in the case of time off to care for a dependent in an emergency, you must grant the time off, although you can decide whether it is paid or unpaid.

What are the exemptions for salaried employees?

Finance ministry has announced a standard deduction of Rs. 40,000 under income tax for salaried employees. The income tax deductions for salaried employees came after the removal of transport allowance (Rs 19,200) and medical reimbursement (Rs 15,000).

What is salaried non exempt?

Employees who do not meet the requirements to be classified as exempt from the Minimum Wage Act are considered nonexempt. Nonexempt employees may be paid on a salary, hourly or other basis. Employees who do not qualify for an exemption but are paid on a salary basis are considered salaried nonexempt.

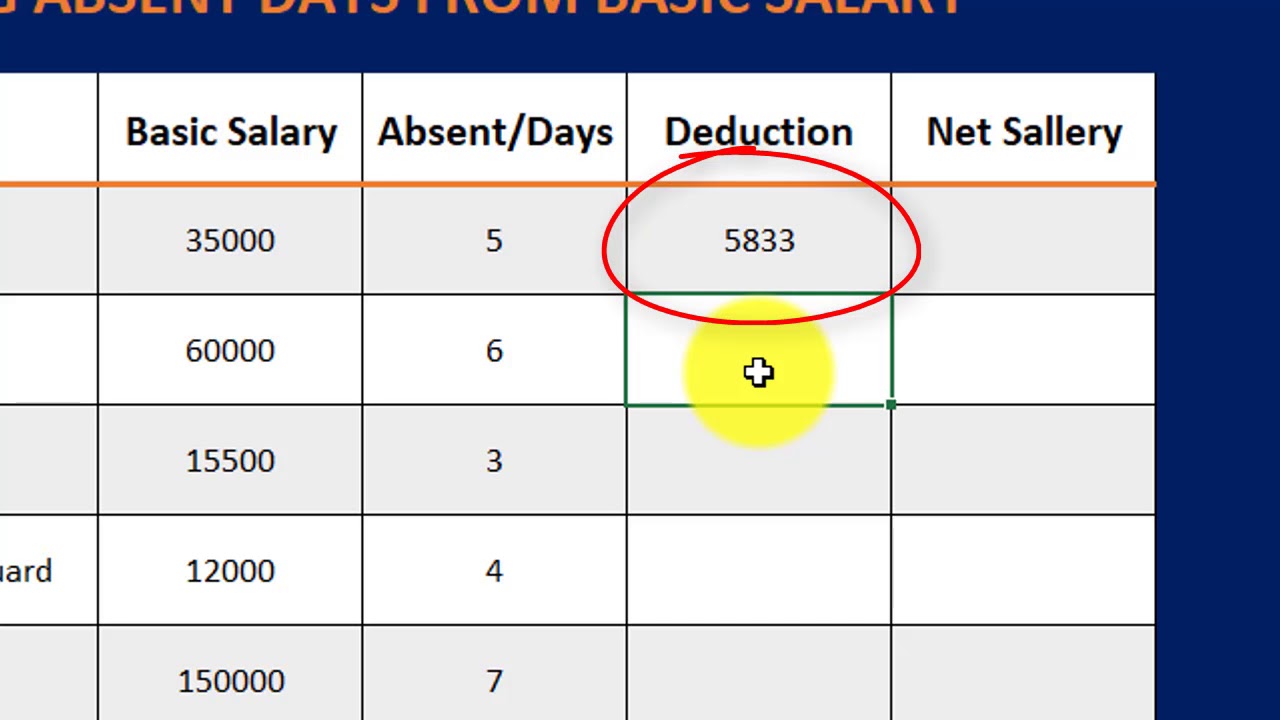

How to deduct absent days from salary ll How to make salary after absent days deduction ll

Images related to the topicHow to deduct absent days from salary ll How to make salary after absent days deduction ll

Is salary or hourly better?

You receive better benefits

Although not always the case, salaried positions typically offer better benefits than hourly paid positions. Companies offer benefits such as paid health, dental, and paramedical insurance, in addition to other perks like registered retirement savings plan (RRSP) matching programs.

Is salary calculated for 30 days or 26 days?

the workers who are on daily wages basis then their salary is calculated for 26 days which is excluding 4 weekly offs, and for staff it is calculated on monthly basis in which weekly offs are paid.

Is salary calculated for 30 or 31 days?

Please note that the standard working days to be considered is 30 days irrespective of whether the number of days in a month is 28/29/30/31 days. For salary calculation you need to consider as 30 days only.

What is the formula for salary calculation?

Annual Basic Salary = Monthly Basic Salary X 12 months.

Though there is no fixed way your basic salary is decided, it is generally calculated using a reversed calculation method by taking a percentage of your gross salary and CTC into consideration. Basic pay is normally 50% of your CTC or 40% of your Gross Pay.

How do I write a salary deduction letter?

Dear Sir, I am writing this letter to inform you about the unjust behavior that happened to me from HR. I am facing an issue from the past 2 months that there has been a reduction in my salary for absolutely no reason. Upon my question, I was given the reasoning that it is due to my un informed offs from office.

How do I write a letter of complaint about salary?

Dear Sir, It is to inform that it’s (Date: DD/MM/YY) and I have not received the salary for the month of (Month name). (Describe in your own words). However, I received the payslip when the salary was not credited to my account.

What is the percentage of basic salary in gross salary?

The components of the salary structure are: Basic Salary: The employee’s basic income is around 40%-50% of the total salary. The employer pays the employee for his skill, experience, and qualifications.

How are leaves calculated in salary slip?

If an employee joins the company at the middle of the calendar year, then the entitled earned leaves will be calculated on a pro-rata basis, from the joining date to December 31 of the same year. If an employee resigns, the entitled leaves are calculated on a pro-rata basis until the last working day.

Is salary calculated for 30 days?

SAP takes total calendar days of the month for calculation of salary in Indian payroll if it is 30 days in a month it takes 30 days and if it 31 days in a month, it takes 31 days.

What is payroll attendance?

Payroll is based on an employee’s attendance data. This data gets generated by the records taken by Biometric/ RFID card in the Time-Attendance terminal that is installed at the entry/exit of the premises. These time-attendance terminals scan authorized credentials (fingerprint, card, face, etc.)

Deduct Employee Salary Based On Unpaid Leaves || Odoo Community Payroll || Odoo 14 Payroll

Images related to the topicDeduct Employee Salary Based On Unpaid Leaves || Odoo Community Payroll || Odoo 14 Payroll

What is unpaid leave called?

Loss Of Pay Leave (LOP/LWP)

In such situations, companies allow them to go on leave without pay (LWP). Since there is a loss of income (LOP) when an employee avails this type of leave, it’s also called LOP leave. Any leave availed in violation of leave policy is considered as LOP by some employers.

Is unpaid leave an entitlement?

While there is no general entitlement to unpaid leave under the Fair Work Act 2009, there are some provisions that deal with the question of when unpaid leave can be taken. In other cases, it is a matter for agreement between the employer and employee.

Related searches to How do I deduct absent days from salary?

- partial day deductions for exempt employees

- how to calculate salary per day

- unpaid leave calculator

- how do i deduct absent days from salary

- do salaried employees get paid if they do not work

- flsa deductions from wages exempt

- how to calculate unpaid leave deduction

- on calculation of monthly salary in the case of absence

- how to deduct absent days from salary

- how is leave days payout calculated

- how to deduct salary for unpaid leave

- how leave days are paid

- unpaid leave salary

- can the employer deduct from salary for partial days of absence

- how to calculate unpaid days from salary

- rules of salary deduction

- how to deduct no pay leave

- how do you calculate unpaid days from salary

Information related to the topic How do I deduct absent days from salary?

Here are the search results of the thread How do I deduct absent days from salary? from Bing. You can read more if you want.

You have just come across an article on the topic How do I deduct absent days from salary?. If you found this article useful, please share it. Thank you very much.