Are you looking for an answer to the topic “How do I record currency conversions in QuickBooks?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

Click the radio button beside “Yes, I Use More Than One Currency.” Select “

” from the “Home Currency” drop-down list. Click the “OK” button to save your preferences. QuickBooks now tracks and automatically converts all foreign currency transactions to U.S. Dollars.A foreign currency transaction is recorded on initial recognition in the functional currency by applying to the foreign currency amount the spot exchange rate between the functional currency and the foreign currency at the date of the transaction.

- Select the Settings menu.

- Go to Company Settings, select Advanced.

- Under the Currency section, select Edit (pencil icon) to set your Home currency. Hint: Use the currency of the country your business is physically located.

- Choose the Multicurrency checkbox to turn it on.

- Select Save and close.

How do I record currency exchange in QuickBooks?

- Select the Settings menu.

- Go to Company Settings, select Advanced.

- Under the Currency section, select Edit (pencil icon) to set your Home currency. Hint: Use the currency of the country your business is physically located.

- Choose the Multicurrency checkbox to turn it on.

- Select Save and close.

How do you record currency exchange?

A foreign currency transaction is recorded on initial recognition in the functional currency by applying to the foreign currency amount the spot exchange rate between the functional currency and the foreign currency at the date of the transaction.

Tracking Multi-currency in QuickBooks Online

Images related to the topicTracking Multi-currency in QuickBooks Online

Does QuickBooks do currency exchange?

QuickBooks uses exchange rates to show how much a foreign currency transaction is in your home currency value. QuickBooks also uses exchange rates for your reports. It converts foreign currency amounts to home currency values so your reports include all transactions.

How do you calculate exchange gain or loss?

Subtract the original value of the account receivable in dollars from the value at the time of collection to determine the currency exchange gain or loss. A positive result represents a gain, while a negative result represents a loss.

How do I record foreign exchange gain or loss in Quickbooks?

- Go to the Lists menu.

- Choose Chart of Accounts.

- Click the Account drop-down menu, then hit New.

- Select Expense, then Continue.

- Enter “bad Debt” in the Account Name field.

- Click Save and Close.

What is the journal entry for foreign currency transactions?

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue.

How do you record foreign currency sales transactions?

Your accounting system must accomplish the following: Record the number of units of the foreign currency you hold. (So, if you have $3,456 US dollars in the US bank account, that’s the number you should be looking at on your balance sheet.) Record the correct value of that asset.

See some more details on the topic How do I record currency conversions in QuickBooks? here:

Set up and use Multicurrency – QuickBooks – Intuit

Go to the Edit menu, then select Preferences. · Select Multiple Currencies. · Go to the Company Preferences tab, then select Yes, I use more than one currency.

How To Enter Multi-Currency PayPal Transactions into …

Open your PayPal transaction history · In QuickBooks create a transfer by clicking the +New button and select Transfer · Enter information for the USD General …

How does multi currency work in QuickBooks Online?

You can turn on Multicurrency if you have customers, vendors, or bank accounts that don’t use your home currency. Once it’s on, you can add transactions in another currency and QuickBooks handles all currency conversions.

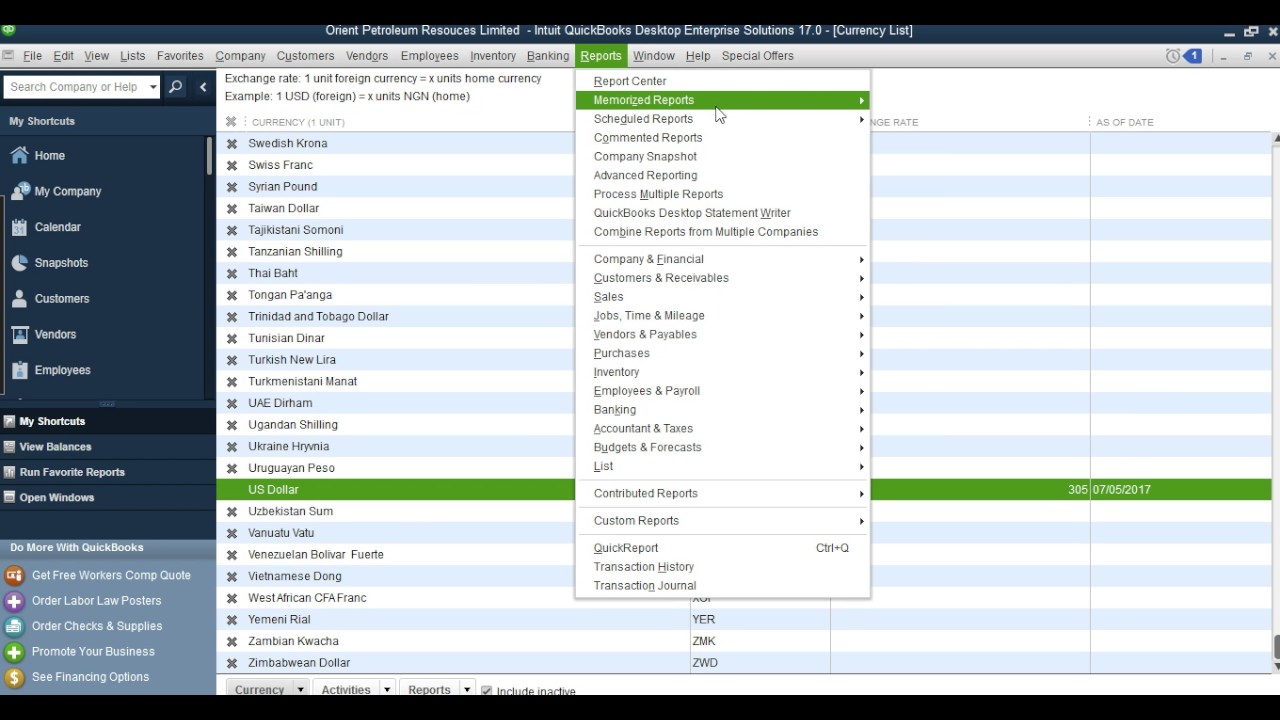

Multiple Currencies Transactions In QuickBooks Desktop

Images related to the topicMultiple Currencies Transactions In QuickBooks Desktop

How do I change the currency on an invoice in QuickBooks?

- In your QBO account, click the Gear icon and select Account and Settings.

- Go to the Advanced menu.

- Select the Currency section and choose your Home Currency.

- Turn on the Multicurrency checkbox, then confirm.

- Click Save, then Done.

Can you have multiple currencies in QuickBooks?

Multicurrency is available as an advanced feature within QuickBooks Online. This feature tracks your foreign currency transactions including any exchange gains or losses you might incur. For countries where we offer multiple versions of QuickBooks Online, multicurrency is available in our Essentials and Plus versions.

How do you calculate foreign currency translation adjustment?

Translation Adjustments:

To keep the accounting equation (A = L + OE) in balance, the increase of $4,500 on the asset (A) side of the consolidated balance sheet when the current exchange rate is used must be offset by an equal $4,500 increase in owners’ equity (OE) on the other side of the balance sheet.

Is foreign exchange loss an operating expense?

Foreign exchange losses are included in other operating expenses. In the previous year, these effects were recognized in the financial result. Under IFRS 9, they are included in operating profit.

How do I report foreign exchange losses?

For capital treatment, complete Lines 151 and 153 of Schedule 3 Capital Gains (or Losses). If you have a gain, report the total from Line 199 on Line 127 of the return. If you have a loss, attach Schedule 3 to the return.

What is foreign exchange loss?

A foreign exchange gain and loss, or FX gain and loss, is the result of a change in the exchange rate used when an invoice is entered at one rate, and valued in a financial statement at another.

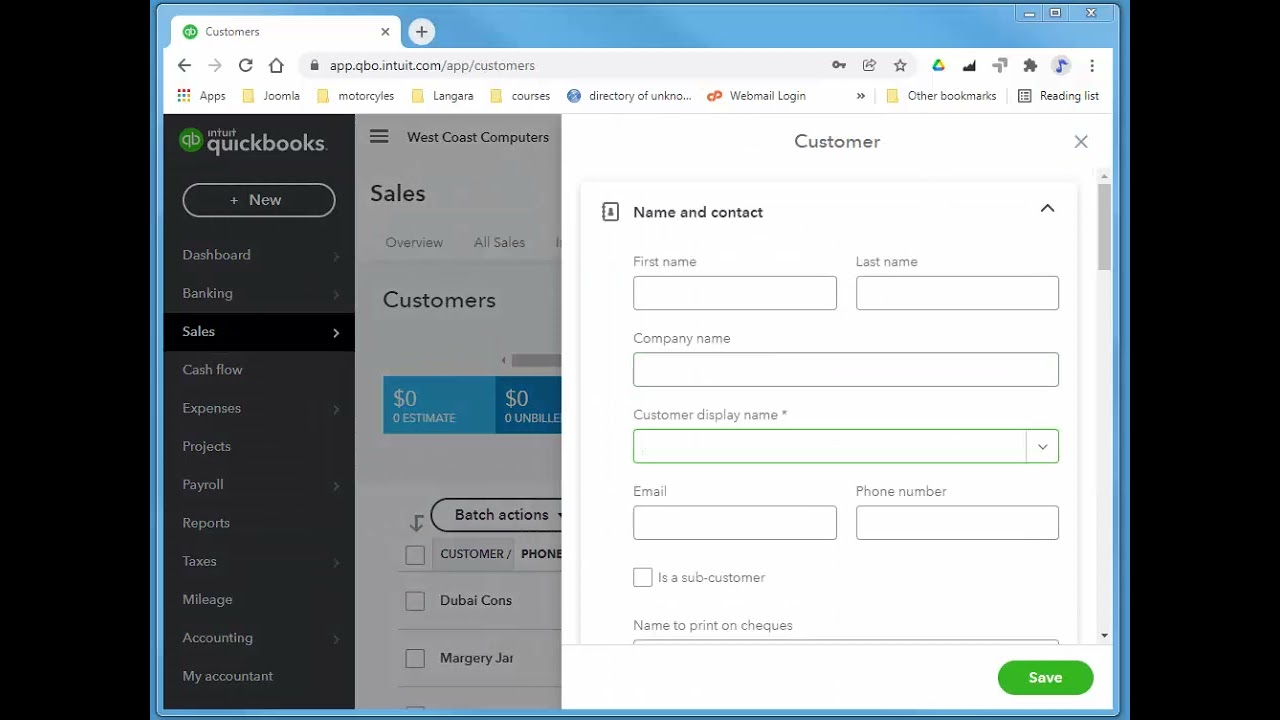

QuickBooks Online – Using Multiple Currencies

Images related to the topicQuickBooks Online – Using Multiple Currencies

Which 3 of these transactions can lead to a gain or loss on foreign exchange?

Correct options are (a), (d), and (e) deposit and invoice payment into a bank account.

What is home currency adjustment in Quickbooks?

What is a home currency adjustment? Home currency adjustments change the home currency value of your foreign balances, recalculating them based on a new rate. These adjustments affect your balance sheet accounts.

Related searches to How do I record currency conversions in QuickBooks?

- how do i record currency conversions in quickbooks desktop

- general currency conversion paypal

- how do i record currency conversions in quickbooks online

- us currency exchange rate

- foreign money exchange near me

- quickbooks receive payment in foreign currency

- quickbooks invoice in euros

- quickbooks international invoice

- foreign exchange rate

- invoice in home currency

Information related to the topic How do I record currency conversions in QuickBooks?

Here are the search results of the thread How do I record currency conversions in QuickBooks? from Bing. You can read more if you want.

You have just come across an article on the topic How do I record currency conversions in QuickBooks?. If you found this article useful, please share it. Thank you very much.