Are you looking for an answer to the topic “How do I record foreign currency transactions in QuickBooks?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

- Go to Banking or Transactions on the left panel.

- Within the For Review tab, find the imported USD transactions.

- Click that transactions and select Find Match or Find other records.

- Make sure to toggle the Foreign currency.

- You can enter dates and search for other information to find the invoices easily.

…

To add foreign-currency accounts:

- Go to the Lists menu, then Chart of Accounts.

- In the Chart of Accounts, right-click anywhere and select New.

- Choose the appropriate account Type and assign a name.

- Select Save & Close.

- Go to the Gear icon at the top and pick Account and settings under Your Company.

- Choose the Advanced menu on the left panel and click the Pencil icon for Currency.

- Toggle the slider for Multicurrency to the right to turn it on.

- Click Save and Close.

Table of Contents

How do I account for foreign currency transactions in QuickBooks?

…

To add foreign-currency accounts:

- Go to the Lists menu, then Chart of Accounts.

- In the Chart of Accounts, right-click anywhere and select New.

- Choose the appropriate account Type and assign a name.

- Select Save & Close.

How do I enter foreign exchange entry in QuickBooks?

- Go to the Gear icon at the top and pick Account and settings under Your Company.

- Choose the Advanced menu on the left panel and click the Pencil icon for Currency.

- Toggle the slider for Multicurrency to the right to turn it on.

- Click Save and Close.

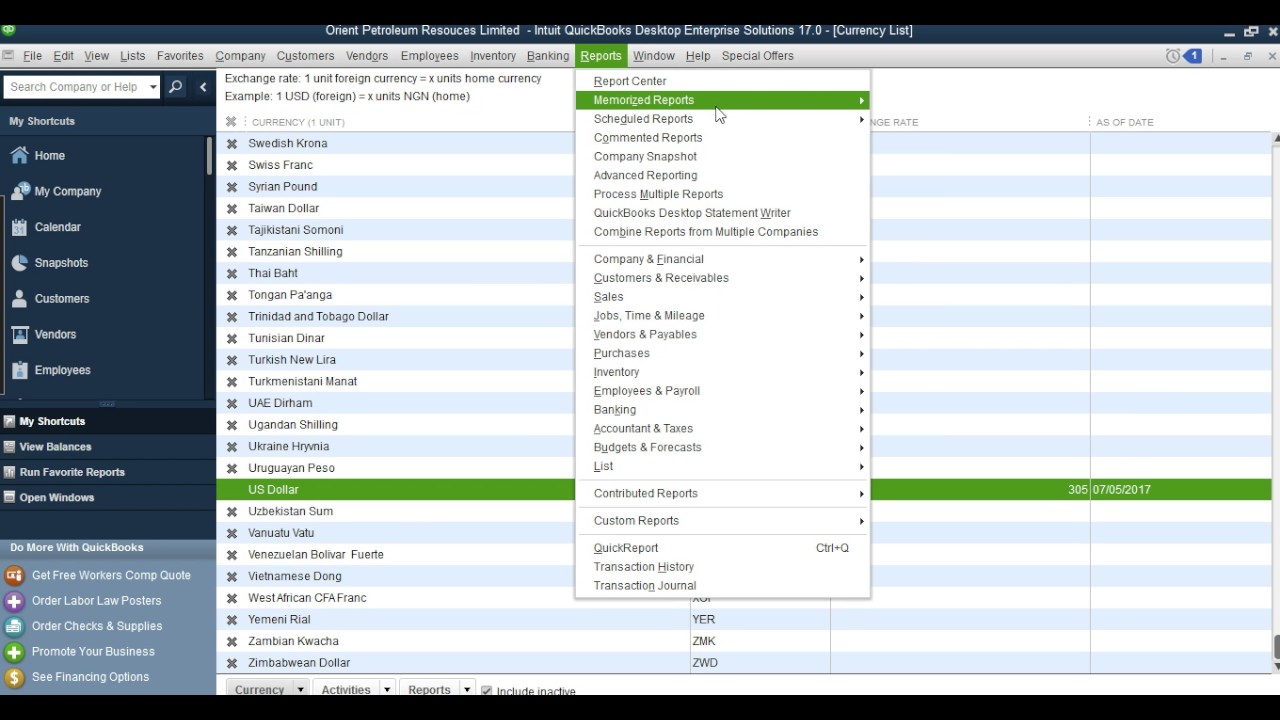

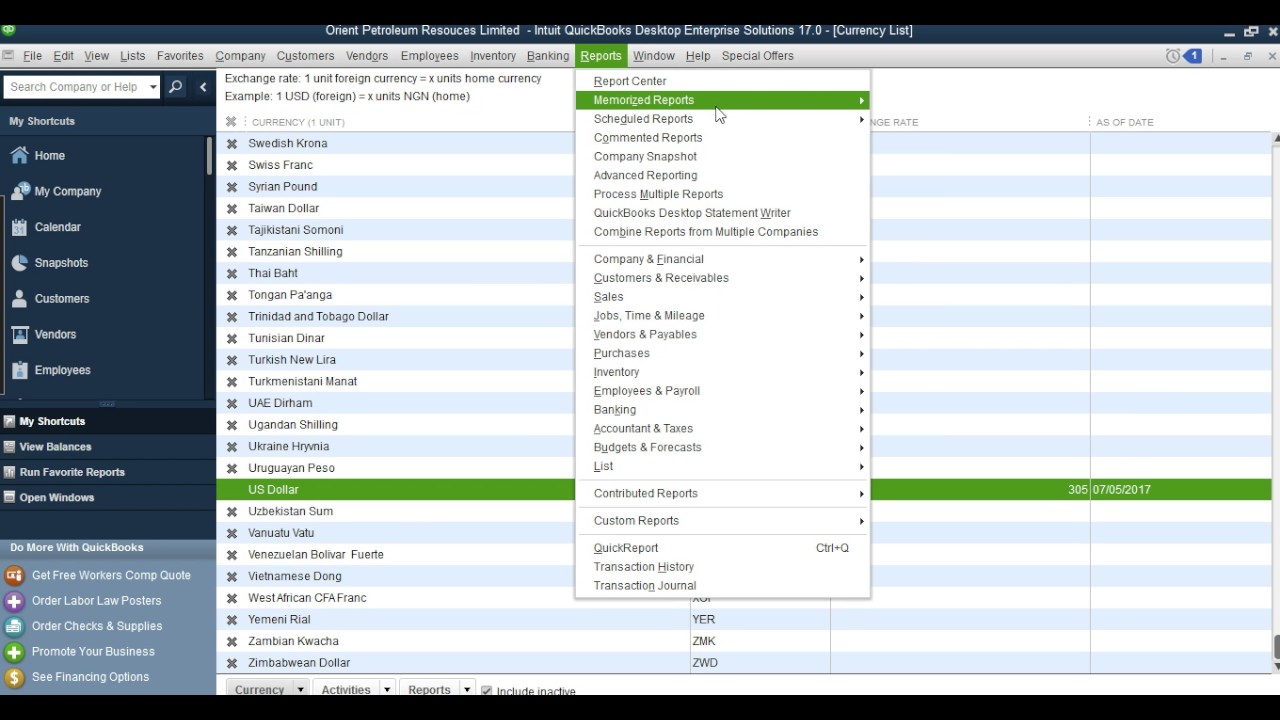

Multiple Currencies Transactions In QuickBooks Desktop

Images related to the topicMultiple Currencies Transactions In QuickBooks Desktop

How do you record foreign currency transactions?

- Translate all foreign currency items into Canadian dollars.

- Record the rate of exchange on the date the transaction occurred.

- Record the gains and losses of the translation between currencies.

How does a multi currency work in QuickBooks Desktop?

With QuickBooks Desktop, you can keep track of transactions in foreign currency. The Multicurrency feature allows you to assign a specific currency type to the following profiles and accounts: Customers. Suppliers.

How does multi currency work in QuickBooks online?

You can turn on Multicurrency if you have customers, vendors, or bank accounts that don’t use your home currency. Once it’s on, you can add transactions in another currency and QuickBooks handles all currency conversions.

Is FX gain a debit or credit?

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue.

How do you allocate payment when there is currency change difference?

- Adding a payment manually from your Cash account, or.

- Uploading a bank statement for bank reconciliation to use the matching feature.

See some more details on the topic How do I record foreign currency transactions in QuickBooks? here:

Add transactions in a foreign currency – QuickBooks

Open the transaction details and select Add. In the currency fields, enter the Foreign amount or the Exchange rate your bank provides. QuickBooks Online …

Set up and use Multicurrency – QuickBooks – Intuit

Go to the Edit menu, then select Preferences. · Select Multiple Currencies. · Go to the Company Preferences tab, then select Yes, I use more than one currency.

Learn about Multicurrency in QuickBooks Online

Step 2: Choose your home currency · Go to Settings ⚙, then select Account and settings. · Select Advanced. · In the Currency section, select Edit …

Add transactions in a foreign currency – QuickBooks

Open the transaction details and select Add. In the currency fields, enter the Foreign amount or the Exchange rate your bank provides.

What is home currency adjustment in Quickbooks?

What is a home currency adjustment? Home currency adjustments change the home currency value of your foreign balances, recalculating them based on a new rate. These adjustments affect your balance sheet accounts.

How are foreign currency transactions treated?

A foreign currency transaction should be recorded, on initial recognition in the reporting currency, by applying to the foreign currency amount the exchange rate between the reporting currency and the foreign currency at the date of the transaction.

QuickBooks Online Receiving Payments In To Foreign And Overseas International Accounts

Images related to the topicQuickBooks Online Receiving Payments In To Foreign And Overseas International Accounts

Where do you record foreign exchange gain or loss?

The foreign currency gain is recorded in the income section of the income statement.

What is accounting for foreign currency?

Foreign Exchange Accounting covers the accounting of the transactions which are carried by a business in different currencies (Foreign currency) other than functional currency, and records such transactions in the functional currency of the reporting entity, based on the exchange rate in effect on the date of …

Does QuickBooks support multiple currencies?

Multicurrency is available as an advanced feature within QuickBooks Online. This feature tracks your foreign currency transactions including any exchange gains or losses you might incur. For countries where we offer multiple versions of QuickBooks Online, multicurrency is available in our Essentials and Plus versions.

How do I create a USD account in QuickBooks?

- Click the Gear icon at the upper-right and select Account and settings.

- From the Advanced menu, scroll down to the Currency section.

- Turn on multicurrency and select the Home Currency and check the terms and considitions box.

- Click Save and then Done.

How do I select currency in QuickBooks?

Go to the Gear icon and select Account and Settings. Proceed to the Advanced tab. Click Currency and change the details in the drop-down list for Home Currency. Select Save, then click Done.

How do I add currency in QuickBooks Online?

- Go to Settings ⚙.

- Select Currencies. Note: This option is available after you turn on multicurrency.

- Select Add currency.

- Select the new currency from the Add Currency ▼ dropdown menu.

- Select Add.

How do I record foreign exchange gain or loss in Quickbooks?

- Go to the Lists menu.

- Choose Chart of Accounts.

- Click the Account drop-down menu, then hit New.

- Select Expense, then Continue.

- Enter “bad Debt” in the Account Name field.

- Click Save and Close.

QuickBooks Online Unrealized Gains And Losses From Currency Exchange

Images related to the topicQuickBooks Online Unrealized Gains And Losses From Currency Exchange

How do you account for foreign currency translation?

There are two main methods of currency translation accounting: the current method, for when the subsidiary and parent use the same functional currency; and the temporal method for when they do not. Translation risk arises for a company when the exchange rates fluctuate before financial statements have been reconciled.

Is foreign exchange loss an operating expense?

Foreign exchange losses are included in other operating expenses. In the previous year, these effects were recognized in the financial result. Under IFRS 9, they are included in operating profit.

Related searches to How do I record foreign currency transactions in QuickBooks?

- transactions can have only one foreign currency at a time

- quickbooks multi currency exchange rate

- how do i record foreign currency transactions in quickbooks online

- quickbooks currency settings

- turn off multi currency in quickbooks online

- quickbooks split transaction

- quickbooks receive payment in foreign currency

- how to turn on multicurrency in quickbooks online

- how do i record foreign currency transactions in quickbooks

- what is true about revaluing foreign balances in quickbooks online

Information related to the topic How do I record foreign currency transactions in QuickBooks?

Here are the search results of the thread How do I record foreign currency transactions in QuickBooks? from Bing. You can read more if you want.

You have just come across an article on the topic How do I record foreign currency transactions in QuickBooks?. If you found this article useful, please share it. Thank you very much.