Are you looking for an answer to the topic “How do I write off bad debt in QuickBooks 2020?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

In the Product/Service section, select Bad debts. In the Amount column, enter the amount you want to write off. In the Message displayed on statement box, enter “Bad Debt.” Select Save and Close.The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. It may also be necessary to reverse any related sales tax that was charged on the original invoice, which requires a debit to the sales taxes payable account.You can write off your customer’s invoice by posting a credit note to your Bad Debts nominal ledger account. This offsets the bad debt against your profit for the current financial year.

- Go to the Customers menu, select Receive Payments.

- locate the name of the customer in the Received from field.

- Enter $0.00 in the Payment amount field.

- Choose Discount and credits.

- In the Amount of Discount field, enter the amount you’d like to write off.

…

Select the Discount tab:

- Enter the amount in the Amount of Discount field.

- Select Minor A/R and A/P Charge-Off in the Discount Account field.

- Select Done to close the Discount and Credits window.

Table of Contents

How do I write off bad debt expense in QuickBooks?

- Go to the Customers menu, select Receive Payments.

- locate the name of the customer in the Received from field.

- Enter $0.00 in the Payment amount field.

- Choose Discount and credits.

- In the Amount of Discount field, enter the amount you’d like to write off.

What is the accounting entry for writing off bad debt?

The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. It may also be necessary to reverse any related sales tax that was charged on the original invoice, which requires a debit to the sales taxes payable account.

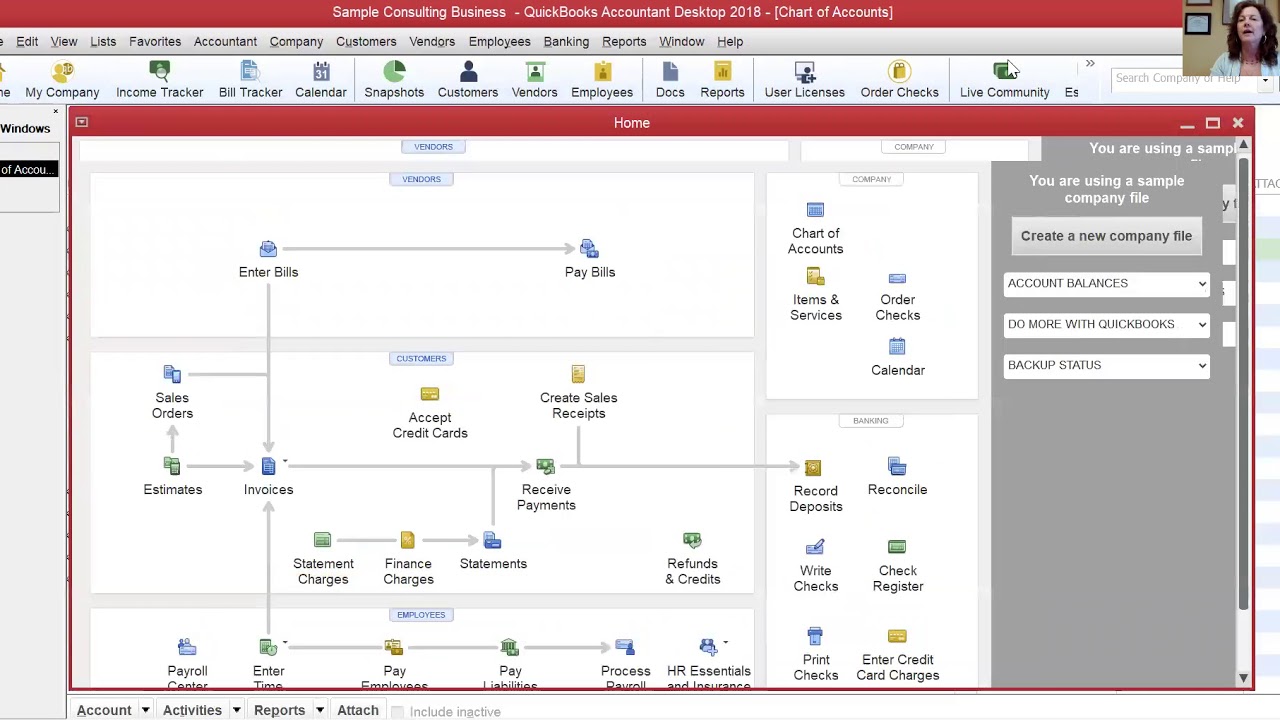

How To Write Off A Bad Debt In QuickBooks

Images related to the topicHow To Write Off A Bad Debt In QuickBooks

How do I write off a bad debt invoice?

You can write off your customer’s invoice by posting a credit note to your Bad Debts nominal ledger account. This offsets the bad debt against your profit for the current financial year.

How do I write off old balances in QuickBooks?

…

Select the Discount tab:

- Enter the amount in the Amount of Discount field.

- Select Minor A/R and A/P Charge-Off in the Discount Account field.

- Select Done to close the Discount and Credits window.

How do I write off an unpaid invoice in QuickBooks?

- Go to Accountant Tools and select Write off invoices.

- Set the Invoice Age, To Date, and Balance less than filters to find the invoice. …

- Review the name in the Customer column.

- Select the checkboxes for the invoices you want to write off.

- Select Write off.

How do I write off overpayments in QuickBooks desktop?

Click the customer name in the Customer: Job field. Select Minor Charge-Off in the Item field and enter the amount of overpayment. Hit Apply Credits. Select the credit in the Available Credits section (The amount of credit should match the amount of invoice).

How can debt be written off?

In some cases, creditors may be willing to write off part of a debt if you offer to pay off the remaining amount in a lump sum, or over a few months. This is known as a full and final settlement, and it’ll be marked on your credit file as a partial payment.

See some more details on the topic How do I write off bad debt in QuickBooks 2020? here:

Write off bad debt in QuickBooks Desktop

Step 1: Add an expense account to track the bad debt · Go to the Lists menu and select Chart of Accounts. · Select the Account menu and then New. · Select Expense, …

Write off bad debt in QuickBooks Online

Step 3: Create a bad debt item · Go to Settings ⚙ and select Products and Services. · At the upper right, select New, and then Non-stock. · In the …

How to Write Off an Invoice in QuickBooks – NerdWallet

1. Open the invoice you are writing off. · 2. Create a new credit memo. · 3. Enter identifying information for the credit memo. · 4. Create the bad debt expense …

Writing off Bad Debt in Accounts Receivable (QuickBooks …

Write Off the Bad Debt in QuickBooks Online · Click on the plus sign (quick create) in the upper right hand corner · Click on credit memo under the column called …

Where are bad debts written off recorded?

Under the direct write-off method, bad debts are expensed. The company credits the accounts receivable account on the balance sheet and debits the bad debt expense account on the income statement.

How much bad debt can a business write off?

For nonbusiness bad debts, you must complete Form 8949. You can use the loss to offset any capital gains you have in the year that the debt became worthless. If your loss exceeds your gain, you get the standard $3,000 deduction against non-capital gain income. Any unused loss carries forward as short-term capital loss.

How do you treat bad debts written off in profit and loss account?

Sometimes, a debt written off in one year is actually paid in the next year – a debit to cash and a credit to irrecoverable debts recovered. The credit balance on the account is then transferred to the credit of the statement of profit or loss (added to gross profit or included as a negative in the list of expenses).

How do you write off accounts receivable uncollectible?

In the direct write-off method, when after a few years of trying to recover the amount the invoice is declared as bad or uncollectible, it is directly written off or expensed out in the income statement by debiting bad debt expense and crediting accounts receivable.

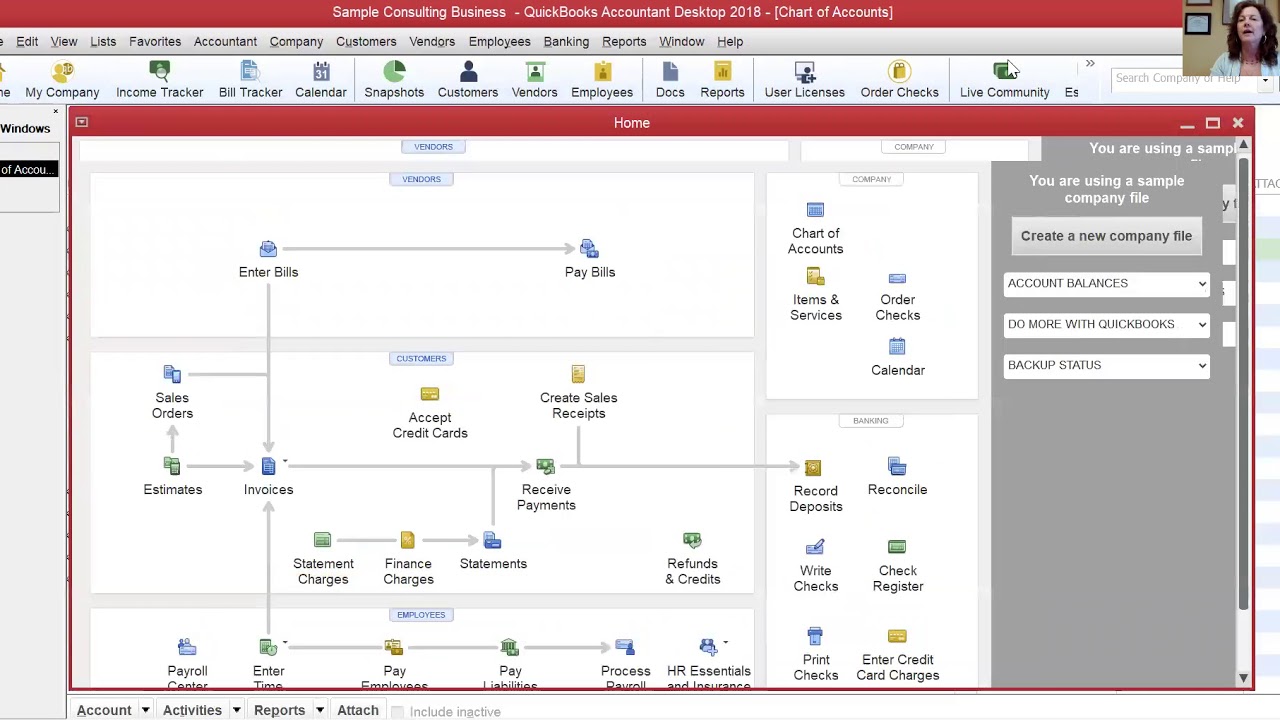

Writing off an invoice to bad debt in Quickbooks Online

Images related to the topicWriting off an invoice to bad debt in Quickbooks Online

How do you write off overpayments?

- Create an invoice for the amount that was overpaid and apply to the invoice to remove it from the Aging report.

- Create a manual GL Journal Entry using the BP with the AR Account. …

- Create a Payment Attribute for over payments and apply during the payment transaction.

How do you write off old accounts payable?

Step One: Reach out to the vendor linked to the accounts payable on the general. Ask that they provide a full statement of account for the previous 12 months. Step Two: Reconcile the account to the vendor statement, marking off all invoices that the company has paid in full.

How do I write off bad debt in QuickBooks Online?

In the Product/Service section, select Bad debts. In the Amount column, enter the amount you want to write off. In the Message displayed on statement box, enter “Bad Debt.” Select Save and Close.

Is it better to void or delete an invoice in QuickBooks?

For good bookkeeping, it’s better to void a transaction, when you can, rather than delete it so you keep a record of the transaction. You can delete all transaction types in QuickBooks, but you can only void certain transaction types.

How do you write off accounts receivable?

- A credit to Accounts Receivable (to remove the amount that will not be collected)

- A debit to Allowance for Doubtful Accounts (to reduce the Allowance balance that was previously established)

How do I handle overpayments in QuickBooks?

- Select + New.

- Select Receive payment.

- Select the customer, then the credit and the invoice.

- Select another pending invoice and enter the overpayment amount in its Payment column.

- Select Save and new or Save and close.

How do I write off QuickBooks desktop?

- Step 1: Check your aging accounts receivable. …

- Step 2: Create a bad debts expense account. …

- Step 3: Create a bad debt item. …

- Step 4: Create a credit memo for the bad debt. …

- Step 5: Apply the credit memo to the invoice. …

- Step 6: Run a bad debts report.

What do you do if a customer has overpaid an invoice?

Use a credit balance adjustment to apply the overpayment as a payment to subsequent invoices. Use a negative invoice charge to apply the overpayment as a credit to a future invoice.

How do you write off a loan in accounting?

Writing it off means adjusting your books to represent the real amounts of your current accounts. To write off bad debt, you need to remove it from the amount in your accounts receivable. Your business balance sheet will be affected by bad debt.

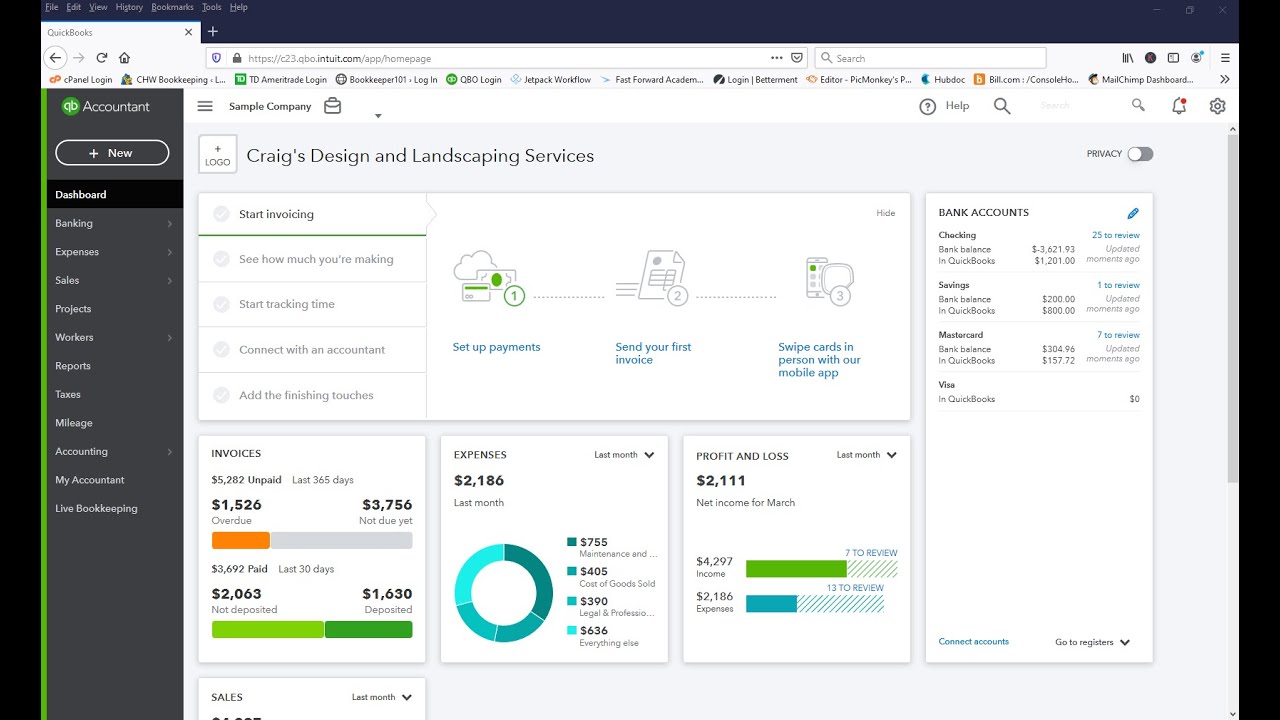

How to Write Off Bad Debt in QuickBooks Online

Images related to the topicHow to Write Off Bad Debt in QuickBooks Online

What is difference between write off and waive off?

Lenders write-off loans to clean up the balance sheet. But, the loan account stays in their books as they hope to recover it at a later date. When a loan is waived-off, the bank will not attempt to take any legal action against the borrower to recover the loan.

How long does it take to write off a debt?

Typically, a credit card company will write off a debt when it considers it uncollectable. In most cases, this happens after you have not made any payments for at least six months.

Related searches to How do I write off bad debt in QuickBooks 2020?

- how to write off bad debt in quickbooks 2020

- write off credit memo in quickbooks

- how do i write off bad debt in quickbooks

- how to write off bad debt in quickbooks online

- how to write off bad debt in quickbooks cash basis

- how do i write off bad debt in quickbooks desktop

- how to write off bad debt in quickbooks enterprise

- write off bad debt journal entry

- how to write off bad debt in quickbooks desktop 2021

- where does bad debt go on chart of accounts

- how do i write off bad debt in quickbooks online

Information related to the topic How do I write off bad debt in QuickBooks 2020?

Here are the search results of the thread How do I write off bad debt in QuickBooks 2020? from Bing. You can read more if you want.

You have just come across an article on the topic How do I write off bad debt in QuickBooks 2020?. If you found this article useful, please share it. Thank you very much.