Are you looking for an answer to the topic “How do I write off bad debt in QuickBooks Online cash basis?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

Generally, to deduct a bad debt, you must have previously included the amount in your income or loaned out your cash. If you’re a cash method taxpayer (most individuals are), you generally can’t take a bad debt deduction for unpaid salaries, wages, rents, fees, interests, dividends, and similar items.However, a cash-basis taxpayer cannot write off the invoice because the amount of the invoice was never included in their taxable income. Remember that a cash-basis taxpayer only includes the income when they receive the payment from the customer.In the Product/Service section, select Bad debts. In the Amount column, enter the amount you want to write off. In the Message displayed on statement box, enter “Bad Debt.” Select Save and Close.

- From the Customers menu and select Receive Payments.

- Select the customer.

- Enter a zero amount in the Payment amount field.

- Select Discounts and credits.

- In the Amount of Discount field, enter the amount you’d like to write off.

- For Discount Account, select the bad debt expense account and select Done.

- Step 1: Check your aging accounts receivable. …

- Step 2: Create a bad debts expense account. …

- Step 3: Create a bad debt item. …

- Step 4: Create a credit memo for the bad debt. …

- Step 5: Apply the credit memo to the invoice. …

- Step 6: Run a bad debts report.

Table of Contents

Can you write off bad debt on a cash basis?

Generally, to deduct a bad debt, you must have previously included the amount in your income or loaned out your cash. If you’re a cash method taxpayer (most individuals are), you generally can’t take a bad debt deduction for unpaid salaries, wages, rents, fees, interests, dividends, and similar items.

How do you write off a cash basis invoice?

However, a cash-basis taxpayer cannot write off the invoice because the amount of the invoice was never included in their taxable income. Remember that a cash-basis taxpayer only includes the income when they receive the payment from the customer.

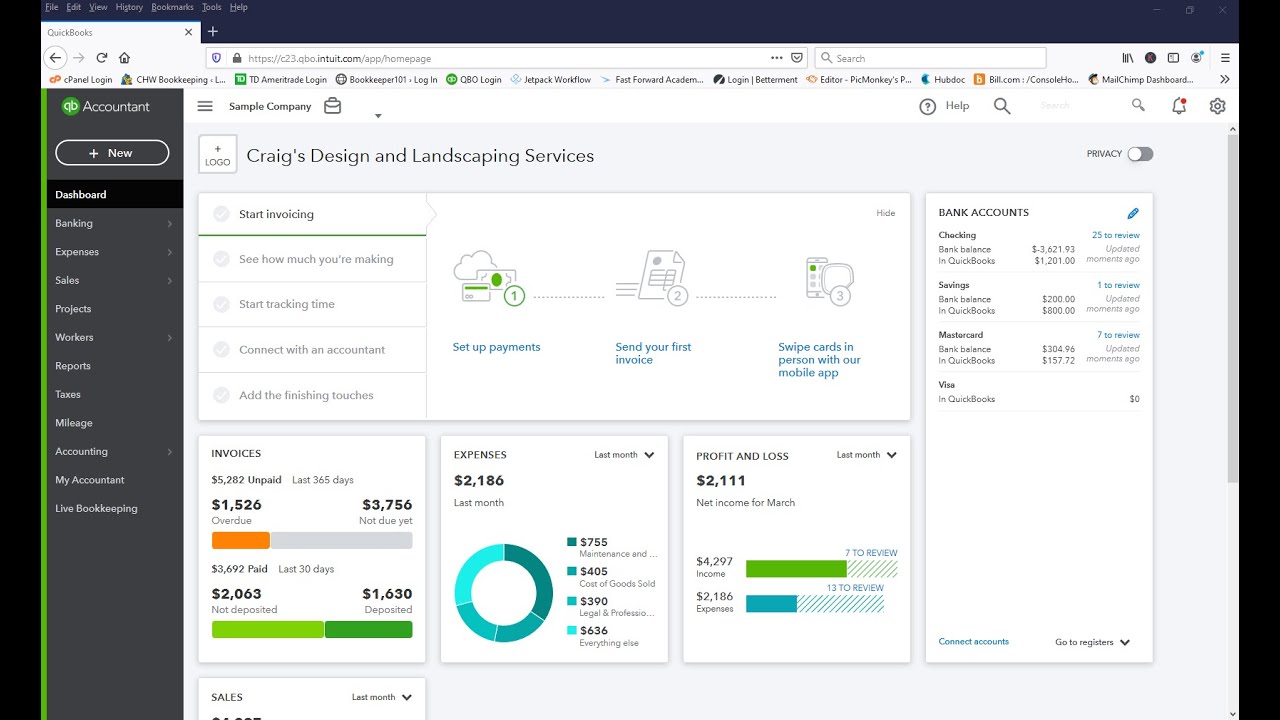

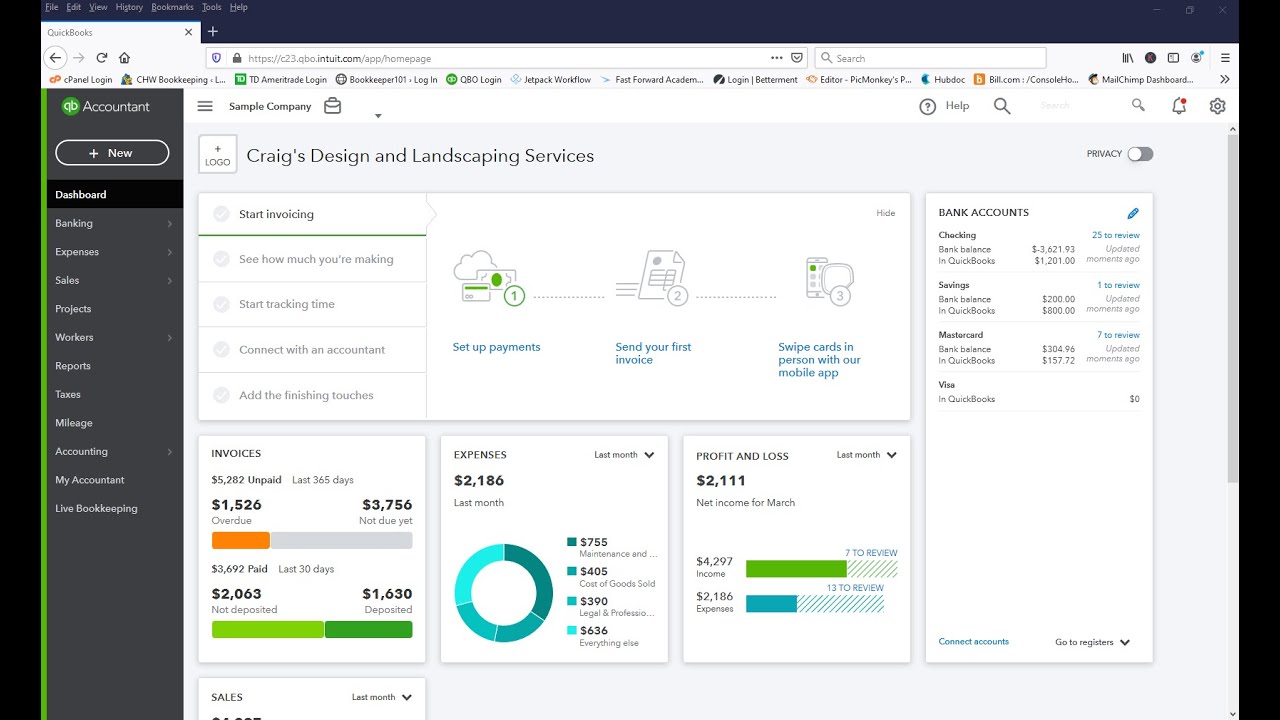

Writing off an invoice to bad debt in Quickbooks Online

Images related to the topicWriting off an invoice to bad debt in Quickbooks Online

What is the best way to write off a bad debt in QuickBooks?

- Step 1: Check your aging accounts receivable. …

- Step 2: Create a bad debts expense account. …

- Step 3: Create a bad debt item. …

- Step 4: Create a credit memo for the bad debt. …

- Step 5: Apply the credit memo to the invoice. …

- Step 6: Run a bad debts report.

How do I write off bad debt in QuickBooks online?

In the Product/Service section, select Bad debts. In the Amount column, enter the amount you want to write off. In the Message displayed on statement box, enter “Bad Debt.” Select Save and Close.

How do you write off bad debt expense?

- Debit Bad Debts Expense (to report the amount of the loss on the company’s income statement)

- Credit Accounts Receivable (to remove the amount that will not be collected)

How do you write off bad debts?

A bad debt can be written off using either the direct write off method or the provision method. The first approach tends to delay recognition of the bad debt expense. It is necessary to write off a bad debt when the related customer invoice is considered to be uncollectible.

How do I write off a small overpayment in Quickbooks?

- From the Customers menu, choose Create Invoices.

- Select the customer name in the Customer:Job field.

- Select Minor Charge-Off in the Item field and enter the amount of overpayment.

- Select Apply Credits.

- Select the credit in the Available Credits section (The amount of credit should match the amount of invoice).

See some more details on the topic How do I write off bad debt in QuickBooks Online cash basis? here:

How to Write Off an Invoice in QuickBooks – NerdWallet

1. Open the invoice you are writing off. · 2. Create a new credit memo. · 3. Enter identifying information for the credit memo. · 4. Create the bad debt expense …

Quickbooks Tips and Tricks: Writing Off Bad Debt – The …

Go to products and service under the gear icon and create a service item called bad debt, and link it to your bad debt reserve account. 2. Create a credit memo.

How to How to Write Off Bad Debt in QuickBooks? – SMB …

How to Write Off Bad Debt in Quickbooks Cash Basis? … If the taxes are filed you on the basis of cash then the best to get the due and …

How to Write Off An Invoice on Quickbooks

First, create an account of the type EXPENSE and call it Bad Debt Expense. Now, go to your Products/Services list and create a Product (Non- …

How do I write off an uncollectible invoice in Quickbooks?

- Go to Customers.

- Select Receive Payments.

- Under RECEIVED FROM, choose your customer.

- From the PAYMENT AMOUNT field, enter the amount.

- Click Save & Close.

- Select OK.

How do you write off old accounts payable?

Step One: Reach out to the vendor linked to the accounts payable on the general. Ask that they provide a full statement of account for the previous 12 months. Step Two: Reconcile the account to the vendor statement, marking off all invoices that the company has paid in full.

How do I write off a loan in QuickBooks?

- First, go to “Lists” and select “Chart of Accounts”

- Choose “Account,” then “New”

- Choose “Expense, then “Continue”

- Enter a new account name. To keep things simple, named this something applicable like “Bad Debt” or “Debt Write-Offs”

- Select “Save and Close”

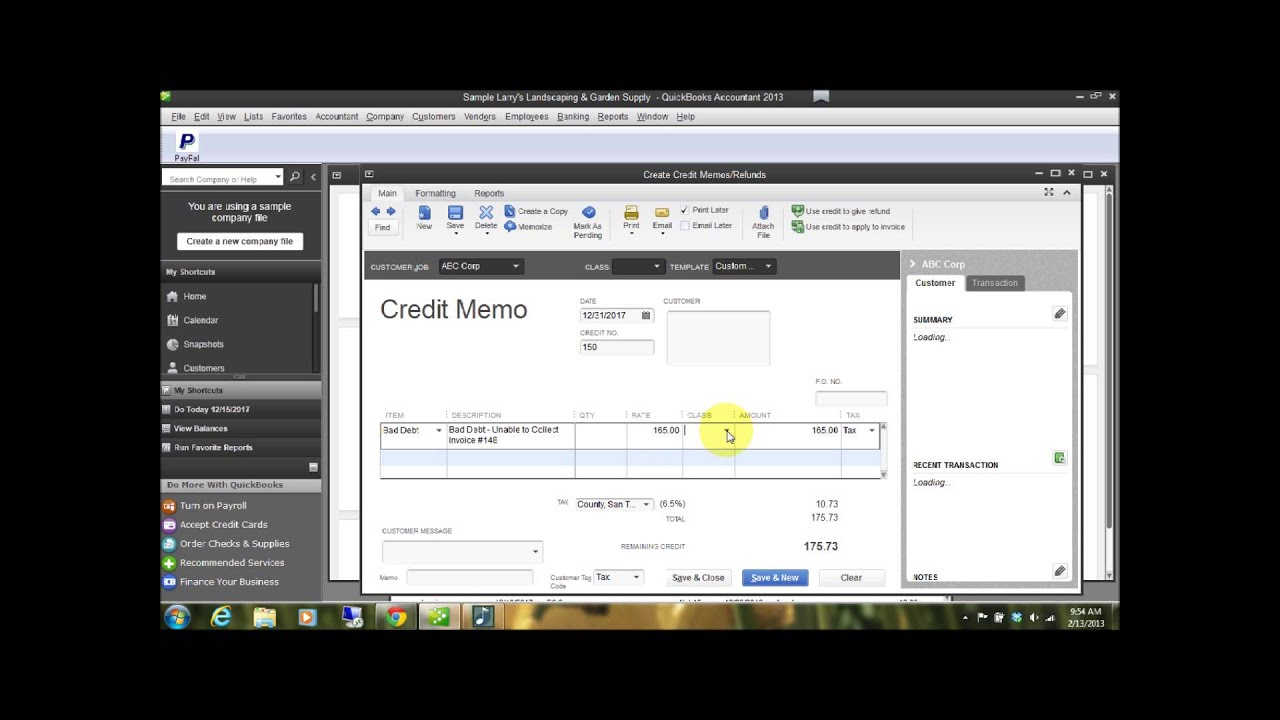

QuickBooks Online Bad Debt Invoice Write Offs Items Method

Images related to the topicQuickBooks Online Bad Debt Invoice Write Offs Items Method

How do you record bad debt expense journal entry?

To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. To record the bad debt recovery transaction, debit your Accounts Receivable account and credit your Bad Debts Expense account. Next, record the bad debt recovery transaction as income.

Are bad debts written-off expenses?

Under the direct write-off method, bad debts are expensed. The company credits the accounts receivable account on the balance sheet and debits the bad debt expense account on the income statement. Under this form of accounting, there is no “Allowance for Doubtful Accounts” section on the balance sheet.

How do you treat bad debts written-off in profit and loss account?

Sometimes, a debt written off in one year is actually paid in the next year – a debit to cash and a credit to irrecoverable debts recovered. The credit balance on the account is then transferred to the credit of the statement of profit or loss (added to gross profit or included as a negative in the list of expenses).

What is the double entry for bad debt written-off?

The double entry for a bad debt will be:

We debit the bad debt expense account, we don’t debit sales to remove the sale. The sale was still made but we need to show the expense of not getting paid. We then credit trade receivables to remove the asset of someone owing us money.

When bad debts can be written off?

Bad Debts. A Deduction is allowed in for the debt related to business and profession if the same has become irrecoverable in the previous financial year. If the Loans lent by banking or money lending concerns are not able to recover the debts in full or part thereof, a deduction may be allowed.

How are bad debts treated in accounting?

Bad debt expenses are generally classified as a sales and general administrative expense and are found on the income statement. Recognizing bad debts leads to an offsetting reduction to accounts receivable on the balance sheet—though businesses retain the right to collect funds should the circumstances change.

When the direct write off method of recognizing bad debt expense is used?

Under the direct write-off method, bad debt expense is recognized only when a receivable is declared to be uncollectible a.k.a. bad debt. For example, on December 1, a business declares $5,000 of its accounts receivable as uncollectible due to the customer becoming bankrupt.

How do you write off overpayments?

- Create an invoice for the amount that was overpaid and apply to the invoice to remove it from the Aging report.

- Create a manual GL Journal Entry using the BP with the AR Account. …

- Create a Payment Attribute for over payments and apply during the payment transaction.

How to Write Off Bad Debt in QuickBooks

Images related to the topicHow to Write Off Bad Debt in QuickBooks

How do I resolve overpayments in QuickBooks Online?

- Go to Taxes & Forms.

- In the Taxes section, select Pay Taxes to check the overpayment. Overpayments appear as negative amounts.

- Select Resolve Overpayment next to the negative amount. It will show you the breakdown of the taxes.

- If applicable, you can select: …

- Select Save.

How do I write off negative accounts receivable in QuickBooks?

- Click the Reports menu located at the top.

- Select Customers & Receivables, and then select A/R Aging Detail.

- Double-click the negative amount.

- Select the duplicate transactions.

- Click the Delete button.

- Select OK in the Delete Transaction window.

Related searches to How do I write off bad debt in QuickBooks Online cash basis?

- write off bad debt in quickbooks desktop

- how should an accrual basis reporting company record a bad debt

- how should you deal with an uncollectible receivable in quickbooks if it includes sales tax

- how to write off bad debt in quickbooks online cash basis

- what are the correct steps to begin the write off invoices process

- bad debt expense cash basis

- how do i void an invoice in quickbooks without affecting prior periods

- where does bad debt go on chart of accounts

- how to write off bad debt in quickbooks desktop 2021

- write off credit memo in quickbooks

Information related to the topic How do I write off bad debt in QuickBooks Online cash basis?

Here are the search results of the thread How do I write off bad debt in QuickBooks Online cash basis? from Bing. You can read more if you want.

You have just come across an article on the topic How do I write off bad debt in QuickBooks Online cash basis?. If you found this article useful, please share it. Thank you very much.