Are you looking for an answer to the topic “How do I write off bad debts in reckon hosted?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

Direct write-off method

To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. To record the bad debt recovery transaction, debit your Accounts Receivable account and credit your Bad Debts Expense account.You can write off your customer’s invoice by posting a credit note to your Bad Debts nominal ledger account. This offsets the bad debt against your profit for the current financial year.

- Step 1: Check your aging accounts receivable. …

- Step 2: Create a bad debts expense account. …

- Step 3: Create a bad debt item. …

- Step 4: Create a credit memo for the bad debt. …

- Step 5: Apply the credit memo to the invoice. …

- Step 6: Run a bad debts report.

Table of Contents

How do you record a bad debt written off?

Direct write-off method

To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. To record the bad debt recovery transaction, debit your Accounts Receivable account and credit your Bad Debts Expense account.

How do I write off a bad debt invoice?

You can write off your customer’s invoice by posting a credit note to your Bad Debts nominal ledger account. This offsets the bad debt against your profit for the current financial year.

Writing Off Bad Debts – Accounts Receivable

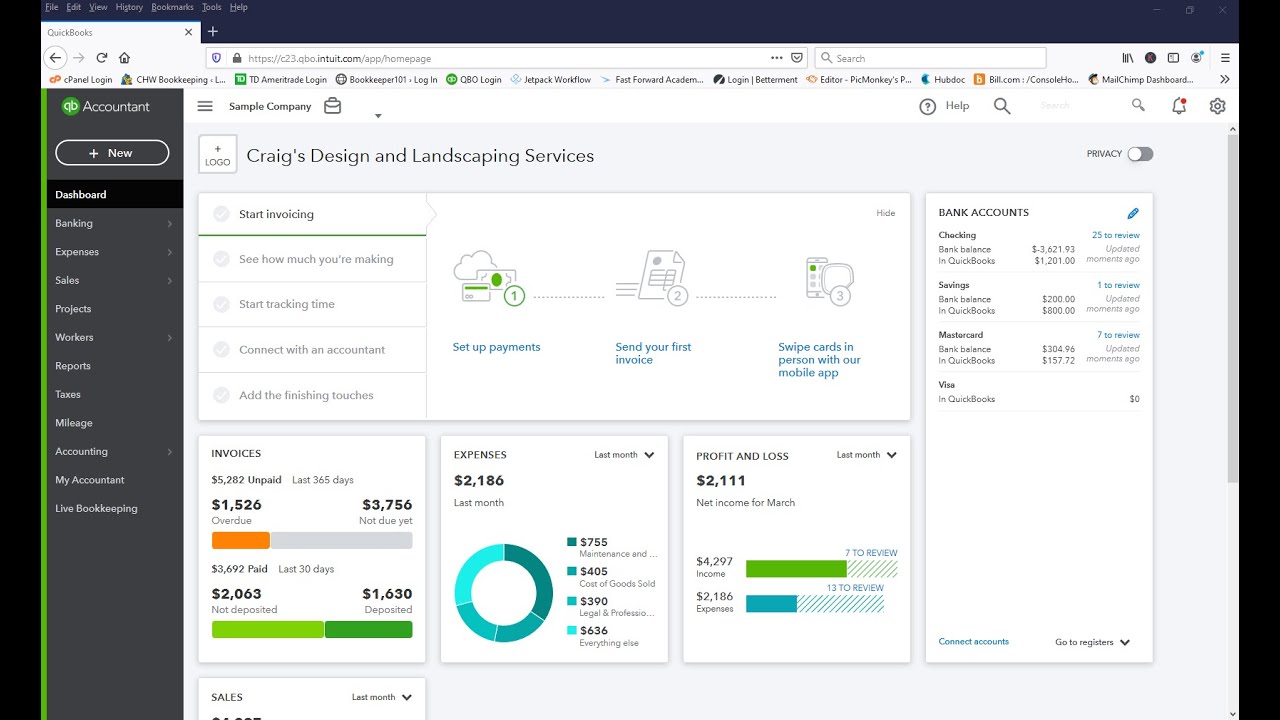

Images related to the topicWriting Off Bad Debts – Accounts Receivable

How do I record a bad debt write off in QuickBooks?

- Step 1: Check your aging accounts receivable. …

- Step 2: Create a bad debts expense account. …

- Step 3: Create a bad debt item. …

- Step 4: Create a credit memo for the bad debt. …

- Step 5: Apply the credit memo to the invoice. …

- Step 6: Run a bad debts report.

How can debt be written off?

In some cases, creditors may be willing to write off part of a debt if you offer to pay off the remaining amount in a lump sum, or over a few months. This is known as a full and final settlement, and it’ll be marked on your credit file as a partial payment.

How do you treat bad debts written off in profit and loss account?

Sometimes, a debt written off in one year is actually paid in the next year – a debit to cash and a credit to irrecoverable debts recovered. The credit balance on the account is then transferred to the credit of the statement of profit or loss (added to gross profit or included as a negative in the list of expenses).

Are bad debts written off expenses?

Under the direct write-off method, bad debts are expensed. The company credits the accounts receivable account on the balance sheet and debits the bad debt expense account on the income statement. Under this form of accounting, there is no “Allowance for Doubtful Accounts” section on the balance sheet.

What is the double entry for bad debt written off?

The double entry for a bad debt will be:

We debit the bad debt expense account, we don’t debit sales to remove the sale. The sale was still made but we need to show the expense of not getting paid. We then credit trade receivables to remove the asset of someone owing us money.

See some more details on the topic How do I write off bad debts in reckon hosted? here:

How to write off a bad debt – AccountingTools

A bad debt can be written off using either the direct write off method or the provision method. The first approach tends to delay …

Write off bad debt in QuickBooks Online

Select + New. · Select Credit note. · Select the customer from the Customer ▽ dropdown. · In the Product/Service section, select Bad debts. · In …

What is Bad Debt and How to Write it Off | Hall Accounting Co.

In the direct write off method, there is no contra asset account (Allowance for Doubtful Accounts book). As a result, everything in the Account Receivable …

How do you write off a bad account? | AccountingCoach

Examples of the Write-off of a Bad Account · Debit Bad Debts Expense, and · Credit Allowance for Doubtful Accounts.

When can bad debts be written off?

The general rule is to write off a bad debt when you’re unable to contact the client, they haven’t shown any willingness to set up a payment plan, and the debt has been unpaid for more than 90 days.

Accounting for Bad Debts (Journal Entries) – Direct Write-off vs. Allowance

Images related to the topicAccounting for Bad Debts (Journal Entries) – Direct Write-off vs. Allowance

How do I write off an unpaid invoice in QuickBooks?

- Go to Accountant Tools and select Write off invoices.

- Set the Invoice Age, To Date, and Balance less than filters to find the invoice. …

- Review the name in the Customer column.

- Select the checkboxes for the invoices you want to write off.

- Select Write off.

How do I write off a balance in QuickBooks?

- From the Vendors menu, select Pay Bills.

- Choose the bill that has the balance that you need to write off.

- Select Set Discount.

- Select the Discount tab. Enter the amount in the Amount of Discount field. …

- Select Pay Selected Bills to close the Pay Bills window.

- Select Done in the Payment Summary window.

How do you write off accounts receivable?

- A credit to Accounts Receivable (to remove the amount that will not be collected)

- A debit to Allowance for Doubtful Accounts (to reduce the Allowance balance that was previously established)

What is difference between write off and waive off?

Lenders write-off loans to clean up the balance sheet. But, the loan account stays in their books as they hope to recover it at a later date. When a loan is waived-off, the bank will not attempt to take any legal action against the borrower to recover the loan.

How do you write off a loan in accounting?

Writing it off means adjusting your books to represent the real amounts of your current accounts. To write off bad debt, you need to remove it from the amount in your accounts receivable. Your business balance sheet will be affected by bad debt.

Can debts be written off after 6 years?

Are debts really written off after six years? After six years have passed, your debt may be declared statute barred – this means that the debt still very much exists but a CCJ cannot be issued to retrieve the amount owed and the lender cannot go through the courts to chase you for the debt.

Where does bad debt expense go on P&L?

Presentation of Bad Debt Expense

The bad debt expense appears in a line item in the income statement, within the operating expenses section in the lower half of the statement.

Writing off an invoice to bad debt in Quickbooks Online

Images related to the topicWriting off an invoice to bad debt in Quickbooks Online

Where are bad debts recorded in profit and loss?

The Provision for Bad and Doubtful Debts will appear in the Balance Sheet. Next year, the actual amount of bad debts will be debited not to the Profit and Loss Account but to the Provision for Bad and Doubtful Debts Account which will then stand reduced.

What is the difference between bad debt and write-off?

A bad-debt expense anticipates future losses, while a write-off is a bookkeeping maneuver that simply acknowledges that a loss has occurred.

Related searches to How do I write off bad debts in reckon hosted?

- how do i write off bad debts in reckon hosted services

- how to write off bad debts in accounting

- how to write off bad debts in quickbooks

- how do i write off bad debts in reckon hosted transactions

- how to write off bad debts in quickbooks online

- how do i write off bad debts in reckon hosted login

- how do i write off bad debts in reckon hosted by

Information related to the topic How do I write off bad debts in reckon hosted?

Here are the search results of the thread How do I write off bad debts in reckon hosted? from Bing. You can read more if you want.

You have just come across an article on the topic How do I write off bad debts in reckon hosted?. If you found this article useful, please share it. Thank you very much.