Are you looking for an answer to the topic “How do prop trading firms work?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

Also known as “prop trading,” this type of trading activity occurs when a financial firm chooses to profit from market activities rather than thin-margin commissions obtained through client trading activity. Proprietary trading may involve the trading of stocks, bonds, commodities, currencies or other instruments.The salaries of Prop Traders in the US range from $42,373 to $793,331 , with a median salary of $203,679 . The middle 57% of Prop Traders makes between $203,679 and $400,084, with the top 86% making $793,331.Day trading firms allow traders to trade with a pool of capital rather than their own money and receive a cut of the profit. These are known as “proprietary trading” or “prop” firms, and working for one can be a lucrative career.

- Pay upfront to be trained by traders before you become a proprietary trader.

- Trade your account first and prove to other prop firms that you’re a profitable trader already and that you’re fit to be a proprietary trader.

Table of Contents

How much do prop traders make?

The salaries of Prop Traders in the US range from $42,373 to $793,331 , with a median salary of $203,679 . The middle 57% of Prop Traders makes between $203,679 and $400,084, with the top 86% making $793,331.

What do proprietary trading firms do?

Day trading firms allow traders to trade with a pool of capital rather than their own money and receive a cut of the profit. These are known as “proprietary trading” or “prop” firms, and working for one can be a lucrative career.

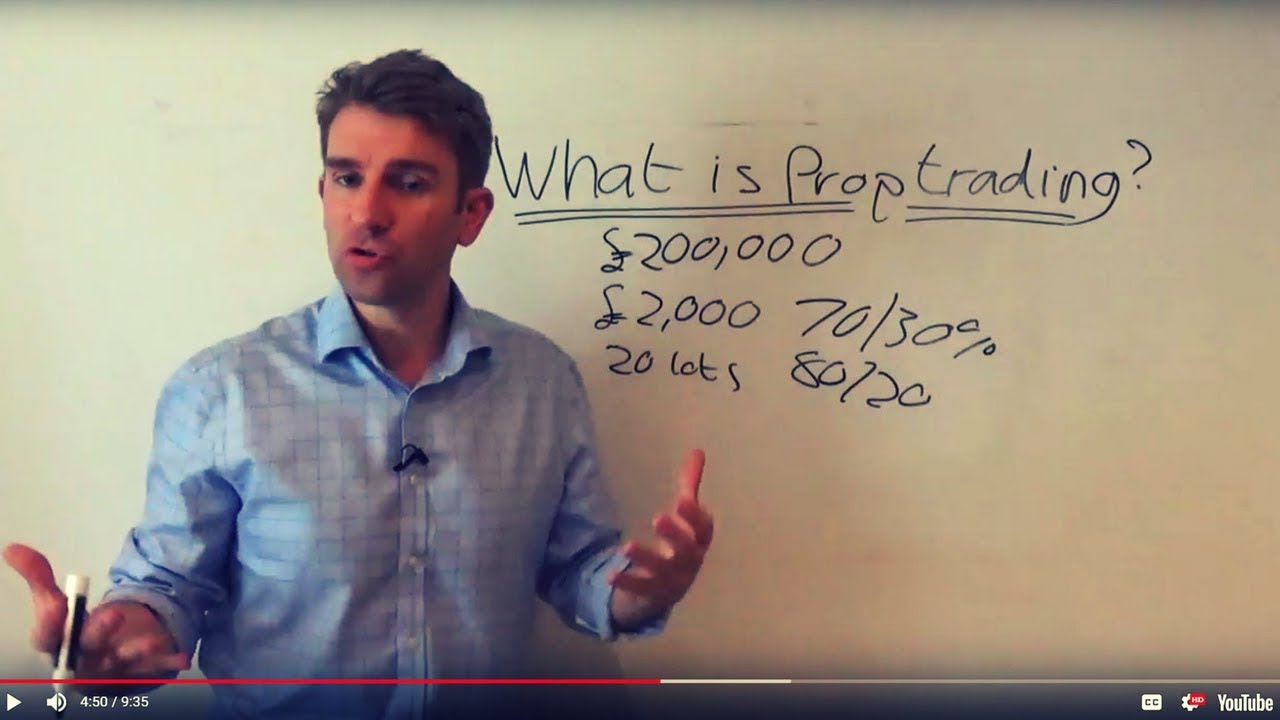

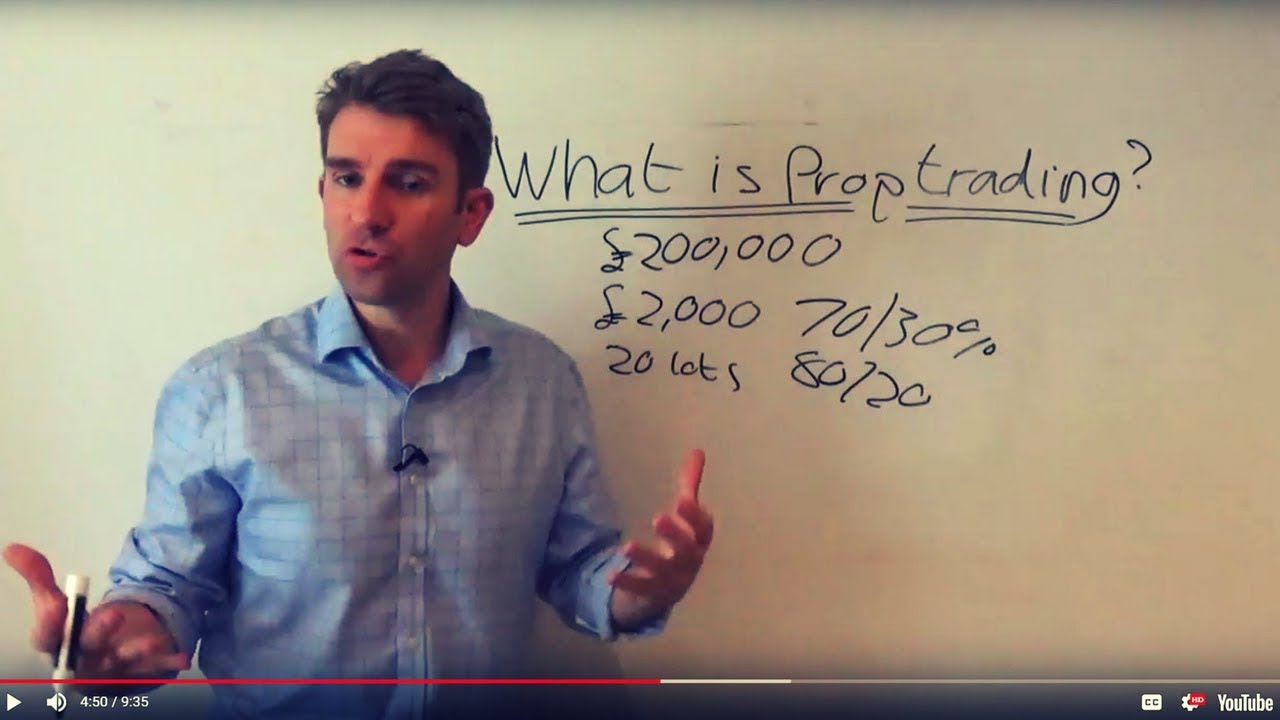

What Is Proprietary Trading? (also Prop Trading) ☝️

Images related to the topicWhat Is Proprietary Trading? (also Prop Trading) ☝️

Are prop firms worth it?

Yes. Prop trading is legit. A good trader can pass an evaluation, pay a one-time fee, get a funded account, and have access to a prop firm’s capital. If they continue to trade profitably, they’ll get more capital to trade (up to $2 million in many cases) and keep a significant portion of the profits they earn.

How do you trade a prop firm?

- Pay upfront to be trained by traders before you become a proprietary trader.

- Trade your account first and prove to other prop firms that you’re a profitable trader already and that you’re fit to be a proprietary trader.

Does prop trading still exist?

Although both fields involve market-making, sales & trading is more about serving clients of the bank and executing trades on their behalf. Also, “prop trading” in the directional sense barely exists at large banks anymore.

Can you day trade with less than 25000?

If the account falls below the $25,000 requirement, the pattern day trader will not be permitted to day trade until the account is restored to the $25,000 minimum equity level. Pattern day traders must maintain minimum equity of $25,000 in their margin accounts.

Is prop trading legal?

The very short answer is no, proprietary trading is not illegal, unless you are a trader at one of the large banks. Thanks to the billions of dollars of losses they suffered during the 2008 financial crisis, banks are no longer allowed to proprietary trade.

See some more details on the topic How do prop trading firms work? here:

Proprietary Trading – What is Prop Trading & How Does It Work?

Proprietary Trading (Prop Trading) occurs when a bank or firm trades stocks, derivatives, bonds, commodities or other financial instruments in its own …

What is Prop Trading and how does it work? – Earn2Trade Blog

For an independent individual, prop trading involves using the capital of a firm to carry out trades. In this case, the individual acts as an …

Proprietary Trading: Full Career and Recruiting Guide

The styles of trading are also quite different because most prop trading firms make money from exploiting small pricing inefficiencies (market-making), while …

Proprietary Trading: How It Works & Career Guide – Analyzing …

Proprietary trading was one of the first employment models wherein a trader would be placed at an institution and use …

How do trading firms make money?

Brokers make money through fees and commissions charged to perform every action on their platform such as placing a trade. Other brokers make money by marking up the prices of the assets they allow you to trade or by betting against traders in order to keep their losses.

How do traders get paid?

Each trader is paid a base salary which is usually very low at the entry level, something like 40K for a new trader. The meat of the pay will come from your bonus, which can easily be 2 or 3 times as much as your base salary. The flip side is that your bonus can also be nothing, zero, niltch, nada (you get the point).

Do prop firms trade stocks?

At prop firms, you can trade a variety of assets, including stocks, futures, and forex. This gives you the flexibility to find the right market to trade in and enhance your trading skills.

How do Proprietary Trading Firms make money?

Images related to the topicHow do Proprietary Trading Firms make money?

Are hedge funds proprietary trading firms?

Unlike proprietary traders, hedge funds are answerable to their clients. Nonetheless, they are also targets of the Volcker Rule that aims to limit the amount of risk that financial institutions can take. Proprietary trading aims at strengthening the firm’s balance sheet by investing in the financial markets.

Do companies hire day traders?

If you want to become a day trader but are interested in finding an alternative option to having $25,000 in your account, you can join a day trading firm. These firms employ day traders to conduct transactions from their offices and typically have more lenient requirements for them.

How do you beat the FTMO challenge?

In summary, you can pass the FTMO challenge by sticking to the maximum drawdown rules, trading duration and reaching the profit target. To achieve this, you’ll need a profitable trading plan, a risk management strategy, a grasp of the rules and a little bit of luck.

What do Jane Street do?

We are a global liquidity provider and market maker, trading mostly products that are listed on exchanges. We trade a wide range of financial products, including ETFs, Equities, Bonds, Options, Commodities, Digital Assets, Futures, and Currencies.

Does Goldman Sachs do proprietary trading?

Our Trading and Principal Investments business facilitates customer transactions and takes proprietary positions through market making in, and trading of, fixed income and equity products, currencies, commodities, and swaps and other derivatives.

How do forex prop firms work?

Most prop traders make money by taking a share of the profit they make by executing trades on behalf of a prop firm. Returns can be multiplied depending on the additional capital provided by a trading firm. Many prop trading firms offer a fixed salary and a bonus based on performance.

Is prop trading allowed by banks?

There are no exceptions as proprietary trading is not prohibited in Singapore.

How much money do day traders with $10000 accounts make per day on average?

Day traders get a wide variety of results that largely depend on the amount of capital they can risk, and their skill at managing that money. If you have a trading account of $10,000, a good day might bring in a five percent gain, or $500.

What taxes do day traders pay?

How is day trading taxed? Day traders pay short-term capital gains of 28% on any profits. You can deduct your losses from the gains to come to the taxable amount.

What is a Proprietary Trading Firm?

Images related to the topicWhat is a Proprietary Trading Firm?

Is day trading like gambling?

It’s fair to say that day trading and gambling are very similar. The dictionary definition of gambling is “the practice of risking money or other stakes in a game or bet.” When you place a day trade, you’re betting that the random price movements of a particular stock will trend in the direction that you want.

Why was prop trading banned?

The Volcker Rule is one of the more controversial pieces of legislation to emerge from the financial crisis. Attached to the Dodd-Frank Act, the rule was intended to limit banks’ ability to make speculative investments that do not benefit their customers.

Related searches to How do prop trading firms work?

- what are prop trading firms

- how do prop traders get paid

- free prop trading firms

- how do prop trading firms work

- how does a prop trading firm work

- how does prop trading work

- prop trading strategies

- proprietary trading firms for beginners

- prop trader salary

- proprietary trading firms

- how much do prop firm traders make

- how do prop firms make money

- how to get a job at a prop trading firm

- the prop trading

- do prop traders make money

- best prop trading firms

Information related to the topic How do prop trading firms work?

Here are the search results of the thread How do prop trading firms work? from Bing. You can read more if you want.

You have just come across an article on the topic How do prop trading firms work?. If you found this article useful, please share it. Thank you very much.