Are you looking for an answer to the topic “How do you investigate check kiting?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

A check kiting analysis is a labor-intensive investigation. The investigator must look at 100 percent of the deposits and deposited items during at least three months of the suspected period. This time is sufficient to determine whether a kite pattern exists.Under California state law, Penal Code § 476a is how check kiting is prosecuted. To be convicted of this, the prosecution must prove that one knowingly wrote a check knowing there were insufficient funds to cover the full amount of the check and in doing so, hoped to obtain something in return for passing the check.The auditor can detect this form of kiting by ensuring any outstanding deposit appearing on a bank reconciliation at balance date that arises from an inter-entity cheque (in the example, the deposit from A of 60) is also recorded by the paying entity as a cheque drawn prior to balance date (and not, as shown above, as …

Table of Contents

How do you prove check kiting?

Under California state law, Penal Code § 476a is how check kiting is prosecuted. To be convicted of this, the prosecution must prove that one knowingly wrote a check knowing there were insufficient funds to cover the full amount of the check and in doing so, hoped to obtain something in return for passing the check.

What is kiting How can an auditor detect kiting?

The auditor can detect this form of kiting by ensuring any outstanding deposit appearing on a bank reconciliation at balance date that arises from an inter-entity cheque (in the example, the deposit from A of 60) is also recorded by the paying entity as a cheque drawn prior to balance date (and not, as shown above, as …

Check Kiting (fraud scheme)

Images related to the topicCheck Kiting (fraud scheme)

Do banks prosecute check kiting?

In the United States, check kites are prosecuted under Title 18, U.S. Code Section 1344, which is defined as obtaining the funds of a federal bank under false pretenses. In effect, a check kite is obtaining an interest-free loan from a bank without the bank’s knowledge.

What is the charge for check kiting?

Legal Penalties

Kiting is a serious crime and is one of the most enforced types of white collar crimes. First-time offenders can face very stiff penalties, including fines of $500,000 or more as well as more than 20 years in prison.

What are the highest indications of kiting?

Indications of a potential check-kiting operation include the following: (1) several accounts owned, or controlled, by the same individual, (2) identifiable patterns of transactions, including deposits, transfers, and withdrawals between those accounts, (3) deposits drawn on other institutions by the same holder of the …

What is the difference between lapping and kiting?

What is the difference between lapping and kiting? Lapping occurs when cash is stolen upon receipt from one customer’s account. Kiting occurs when funds are stolen from the company and, to cover this theft, the employee transfers money from one bank account to another account right before year-end.

Which of the following is an example of a check kiting scheme?

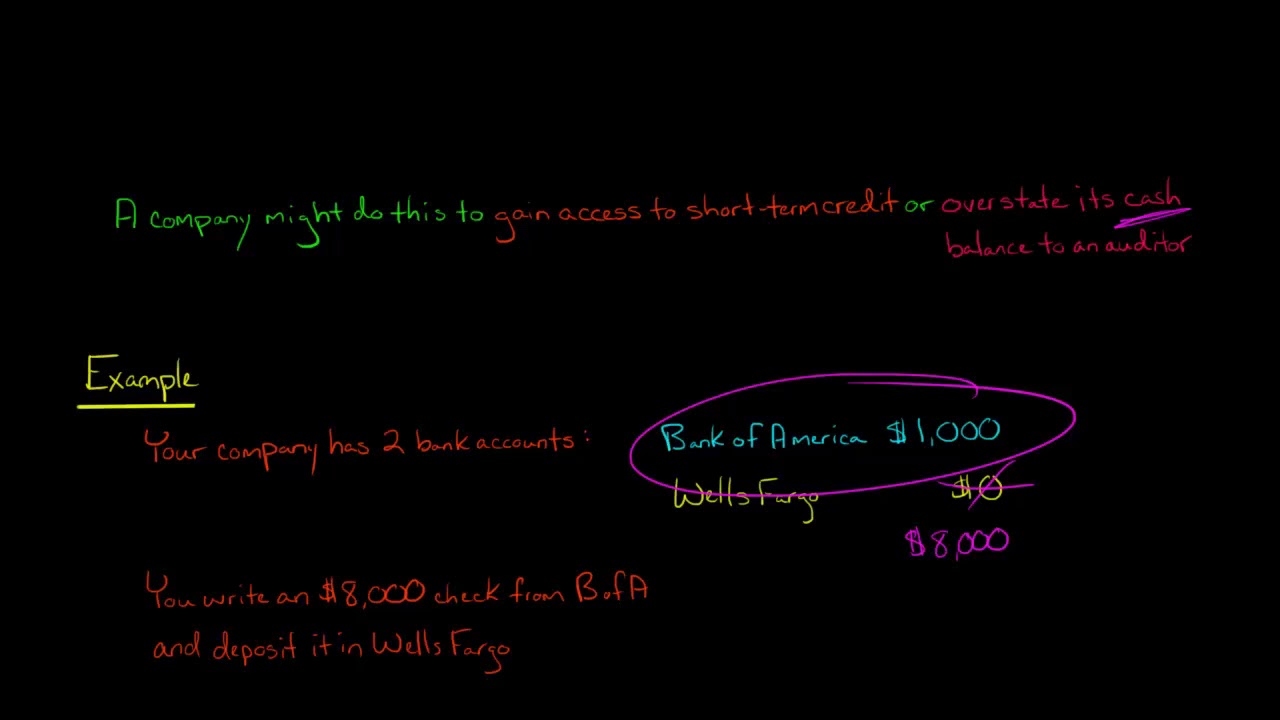

A simple example of check kiting is to write a check from Bank A, where you have insufficient funds, and deposit that check into an account at Bank B, which also lacks funds.

See some more details on the topic How do you investigate check kiting? here:

Twelve Factors to Monitor for Check Kiting – InterAction Training

Here are steps to identify check-kiting and minimize risk in the interim · Alert management. · Place special instructions on the account to alert other tellers.

Tips for Detecting Check-Kiting Schemes – SQN Banking …

Get tips on how to protect your financial institution from check kiting. Learn why you need to analyze multiple transactions to detect check-kiting schemes.

CHECK KITING: DETECTION, PROSECUTION, AND …

The authors discuss what can be done about check kiting–the fraudulent use of checks between two or more bank accounts to cover the fact of insufficient funds.

Anatomy of Check-Kiting Fraud | Bankrate.com

Here’s how it works. Suppose you have $10 in bank A but you write a check on the account for $500 and deposit it in bank B. Before that deposit …

Example: Check Kiting | Auditing and Attestation | CPA Exam

Images related to the topicExample: Check Kiting | Auditing and Attestation | CPA Exam

How do I stop check kiting?

- Only accept checks for the exact amount owed to you. …

- Wait until the check clears to refund the overpayment. …

- Look into checks that clear your bank account out of sequence. …

- Restrict access to company checks if you’re a business owner.

What happens if you unknowingly deposit a fake check?

The consequences of depositing a fake check — even unknowingly — can be costly. You may be responsible for repaying the entire amount of the check. While bank policies and state laws vary, you may have to pay the bank the entire amount of the fraudulent check that you cashed or deposited into your account.

Is kiting checks illegal?

Check kiting is the illegal process of writing a check off of a bank account with inadequate funds to cover that check. Check kiting relies on the fact that it takes banks a few days (or even longer for international checks) to determine that a check is bad.

Who investigates check kiting?

The American Bankers Association describes check-kiting as “the process of floating worthless checks between accounts established in two or more banks.” ABA goes on to state “a kiter is able to create the impression of having a real balance in each of the banks by carefully timing deposits and checks, and taking …

What is check kiting and why is it illegal?

While it might seem like it is a clever way to get the money they need, it’s a form of fraud that’s illegal. Check kiting essentially turns a bad check into a form of credit, but this isn’t authorized and it can lead to trouble for banks. A person who’s caught doing this can face criminal charges and civil charges.

Is check kiting money laundering?

Kiting is the fraudulent use of a financial instrument to obtain additional credit that is not authorized. Kiting encompasses two main types of fraud: Issuing or altering a check or bank draft, for which there are insufficient funds.

What is Check Kiting?

Images related to the topicWhat is Check Kiting?

What is ACH kiting?

In ACH check kiting, a criminal will juggle money bank and forth between accounts at separate banks so that the ACH is registered as valid when it is checked, but then the money is gone by the time the transfer goes through.

What qualities does a counterfeit check have?

- Edges: Most legit checks have at least one perforated or rough edge. …

- Bank logo: A fake check often has no bank logo or one that’s faded, suggesting it was copied from an online photo or software.

- Bank address: No street address, just a P.O.

Related searches to How do you investigate check kiting?

- regulation cc holds include which other types of holds

- check kiting example

- how do you investigate check kiting example

- how do you investigate check kiting in sap

- how do you investigate check kiting in the us

- how do you investigate check kiting on a website

- how do you investigate check kiting in sap abap

- how to detect kiting audit

- my bank closed my account for check kiting

Information related to the topic How do you investigate check kiting?

Here are the search results of the thread How do you investigate check kiting? from Bing. You can read more if you want.

You have just come across an article on the topic How do you investigate check kiting?. If you found this article useful, please share it. Thank you very much.