Are you looking for an answer to the topic “How long can you legally be chased for a debt Philippines?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

For most debts, the time limit is 6 years since you last wrote to them or made a payment.Debt collections typically last up to seven years, which can be the reason why people think that debts are removed from the bank’s database after that. But just because you’ve stopped receiving calls or letters from agents doesn’t mean your debts have been eliminated.No Jail Time, I am Debt Proof

Well, Philippine laws do provide for the prohibition against imprisonment by reason of indebtedness. Article III, Section 20 of the 1987 Constitution states that, “No person shall be imprisoned for debt or non-payment of a poll tax.” In the case of Lozano vs. Martinez, Lozano vs.

Table of Contents

How many years before debt is written off in Philippines?

Debt collections typically last up to seven years, which can be the reason why people think that debts are removed from the bank’s database after that. But just because you’ve stopped receiving calls or letters from agents doesn’t mean your debts have been eliminated.

Can you get jailed for debt in Philippines?

No Jail Time, I am Debt Proof

Well, Philippine laws do provide for the prohibition against imprisonment by reason of indebtedness. Article III, Section 20 of the 1987 Constitution states that, “No person shall be imprisoned for debt or non-payment of a poll tax.” In the case of Lozano vs. Martinez, Lozano vs.

Can you be jailed for non-payment of a debt?

Images related to the topicCan you be jailed for non-payment of a debt?

Can I be chased for debt after 7 years?

In California, you can’t be sued for consumer debt older than four years. But making even a partial payment can restart the debt clock. Some businesses and debt collectors may want you to think your financial obligations will trouble you forever unless you come across with some cash.

What happens if you ignore debt collectors Philippines?

Financing and lending companies found to be violating the circular face penalties ranging from P25,000 for lending companies and P50,000 for financing companies for the first offense to P50,000 to up to P1 million for both for the third offense and possible suspension or revocation of their license.

Does debt expire in Philippines?

A debt collector is legally entitled to collect a debt even after the statute of limitations of seven years has run out. However, the debt collector is breaking the law if they sue you over the debt or even threatens to sue you. The statute of limitation does not eliminate the debt.

What happens after 7 years of not paying debt?

Unpaid credit card debt will drop off an individual’s credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the person’s credit score.

Can debt collectors come to your house Philippines?

Can a debt collector come to your house without notice? Yes, there’s no formal process that debt collectors have to follow, unlike court appointed representatives, such as bailiffs.

See some more details on the topic How long can you legally be chased for a debt Philippines? here:

Debt Collection Philippines | Cedar Financial

What is the typical debt collection process? 1 Letter – Then wait three or four days depending on where the debtor is. 2 Phone debtor. 3 If the debtor will not …

Lender has 10 years to collect debt | The Manila Times

Lender has 10 years to collect debt.

How long can you legally be chased for a debt … – Travel in you

Collections typically last to seven years. A debt collector is legally …

Quick Answer: How Long Can You Legally Be Chased For A …

Collections typically last to seven years. A debt collector is …

Can you go to jail for not paying a personal loan Philippines?

Will I go to jail if I have an unpaid loan? As explicitly stated in the 1987 Philippine Constitution under Section 20 of Article III, no one shall be imprisoned due to debt, so you don’t need to worry about debt collectors threatening you that they will send out the police to arrest you tomorrow.

Is there an imprisonment for non-payment of debt Why?

No one can be imprisoned for non-payment of debt, true. However, they can be imprisoned for committing crimes: such as selling a personal property that they mortgaged while the debt is still unpaid, or the use of “deceit” to make the debtor part with the money.

Is it true that after 7 years your credit is clear?

Highlights: Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

Do debts expire?

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

Can a debt collector collect after 10 years?

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can’t typically take legal action against you.

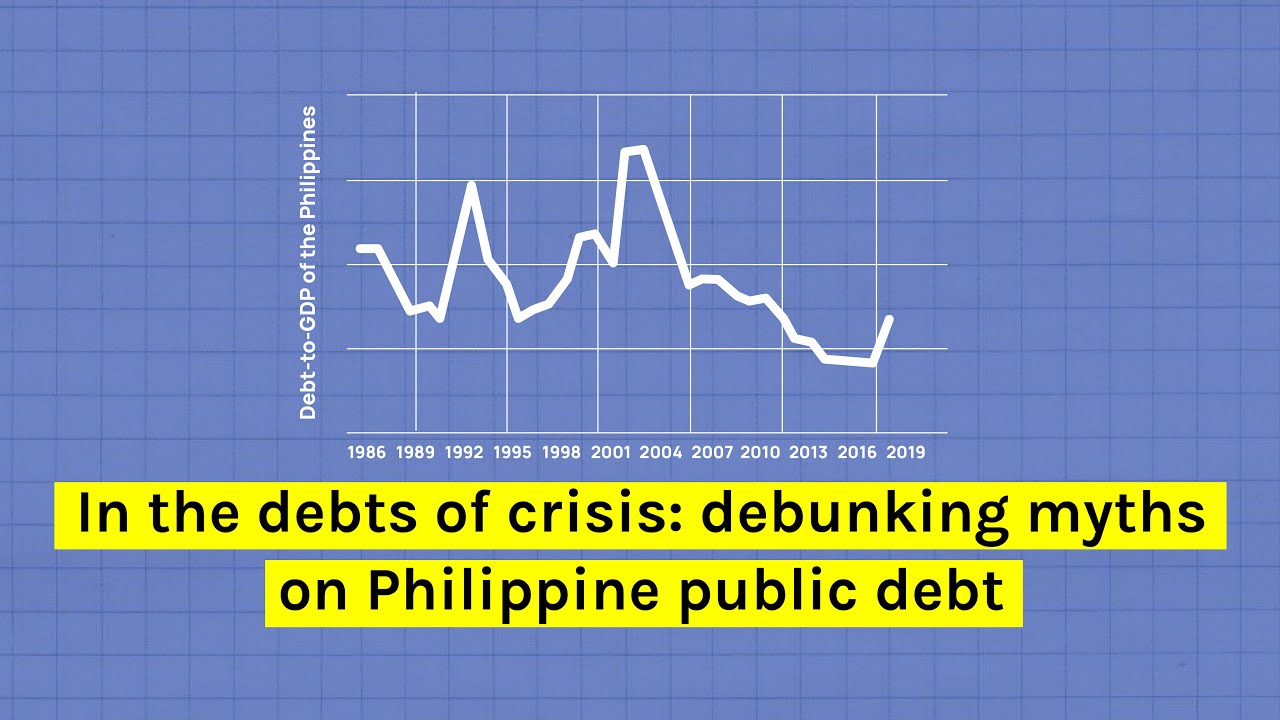

Our Way Forward | In the Debts of Crisis: Debunking Myths on Philippine Public Debt

Images related to the topicOur Way Forward | In the Debts of Crisis: Debunking Myths on Philippine Public Debt

Can debt collectors blacklist you?

Any time you fail to consolidate an outstanding loan, you may be blacklisted, and the effect of that is the rejection of your requests anytime you try to apply for a loan from any creditor.

How long can you ignore debt collectors?

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

What happens if debt collector Cannot find you?

If a bill collector cannot locate you, it is allowed to reach out to third parties, such as relatives, neighbors or your employer, but only to find you. They aren’t allowed to disclose that you owe a debt or discuss your finances with others.

How do I deal with debt collectors in the Philippines?

One is to report them to the Financial Consumer Protection Department of the BSP (i.e. email [email protected] or call 632-708-7087). Be sure to document all communications with your debt collectors including text messages and e-mails. If you can, record your conversation with their consent.

How do I clear my name from credit bureau Philippines?

- If you don’t already have one, start building a credit history. …

- Gather your own financial records. …

- If you’re already in debt, don’t apply for another credit card. …

- Get back on track with all your bills. …

- Pay down your debt. …

- Negotiate with lenders.

What happens if I don’t pay my credit card for 5 years?

If you continue to not pay, your issuer may close your account, though you’ll still be responsible for the bill. If you don’t pay your credit card bill for a long enough time, your issuer could eventually sue you for repayment or sell your debt to a collections agency (which could then sue you).

Does debt disappear after 6 years?

Are debts really written off after six years? After six years have passed, your debt may be declared statute barred – this means that the debt still very much exists but a CCJ cannot be issued to retrieve the amount owed and the lender cannot go through the courts to chase you for the debt.

How long does it take for a debt to be written off?

Can Old Debts be Written Off? Well, yes and no. After a period of six years after you miss a payment, the default is removed from your credit file and no longer acts negatively against you.

What happens when a debt is written off?

When a credit card company writes off a debt, it will typically sell it—usually for pennies on the dollar—to a collection agency or other debt collector. Then the collection agency can come after you to collect the debt. Debt collectors make money by squeezing more payments out of you than what they paid for the debt.

What are the collection law in the Philippines?

M.C. 18 of 2019 seeks to prevent Financing Companies and Lending Companies from harassing borrowers and engaging in unethical, abusive and/or unfair practices when seeking to collect debts. This prohibition applies whether the company is seeking to collect the debts itself or via a third party service provider.

My Debt Confession l Why we are buried deeply into Debt l Philippines

Images related to the topicMy Debt Confession l Why we are buried deeply into Debt l Philippines

Can I go to jail for not paying online loans in the Philippines?

You can’t be arrested for debt just because you’re behind on payments. No creditor of consumer debt — including credit cards, medical debt, a payday loan, mortgage or student loans — can force you to be arrested, jailed or put in any kind of court-ordered community service.

What should you not say to debt collectors?

- Additional Phone Numbers (other than what they already have)

- Email Addresses.

- Mailing Address (unless you intend on coming to a payment agreement)

- Employer or Past Employers.

- Family Information (ex. …

- Bank Account Information.

- Credit Card Number.

- Social Security Number.

Related searches to How long can you legally be chased for a debt Philippines?

- how long can you legally be chased for a debt

- how long can you legally be chased for a debt in south africa

- when do debt collectors give up

- how long can you be chased for an unpaid debt

- how to collect debt philippines

- fair debt collection practices act philippines

- how long can you legally be chased for a debt in the philippines

- law on debt philippines 2020

- bench warrant for unpaid debt philippines

- how long can i be chased for a debt

- how to sue someone for unpaid debt philippines

- criminal case for not paying debt philippines 2021

- philippine law about unpaid debt

Information related to the topic How long can you legally be chased for a debt Philippines?

Here are the search results of the thread How long can you legally be chased for a debt Philippines? from Bing. You can read more if you want.

You have just come across an article on the topic How long can you legally be chased for a debt Philippines?. If you found this article useful, please share it. Thank you very much.