Are you looking for an answer to the topic “How should discount on bonds payable be reported on the financial statements premium on bonds payable?“? We answer all your questions at the website Chiangmaiplaces.net in category: +100 Marketing Blog Post Topics & Ideas. You will find the answer right below.

Discount (premium) on bonds payable should be reported in the balance sheet as a direct deduction from (addition to) the face amount of the bond. Both are liability valuation accounts.The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the par value of the bonds in the liabilities section of the balance sheet.Discount on Bonds Payable is a contra liability account that is debited for the purpose of offsetting a credit on a liability account Bonds Payable and reporting the net book value, or carrying value, of an entity’s outstanding bonds.

Table of Contents

How should discount and premium on bonds payable be reported on the financial statements?

The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the par value of the bonds in the liabilities section of the balance sheet.

How is discount on bonds payable reported?

Discount on Bonds Payable is a contra liability account that is debited for the purpose of offsetting a credit on a liability account Bonds Payable and reporting the net book value, or carrying value, of an entity’s outstanding bonds.

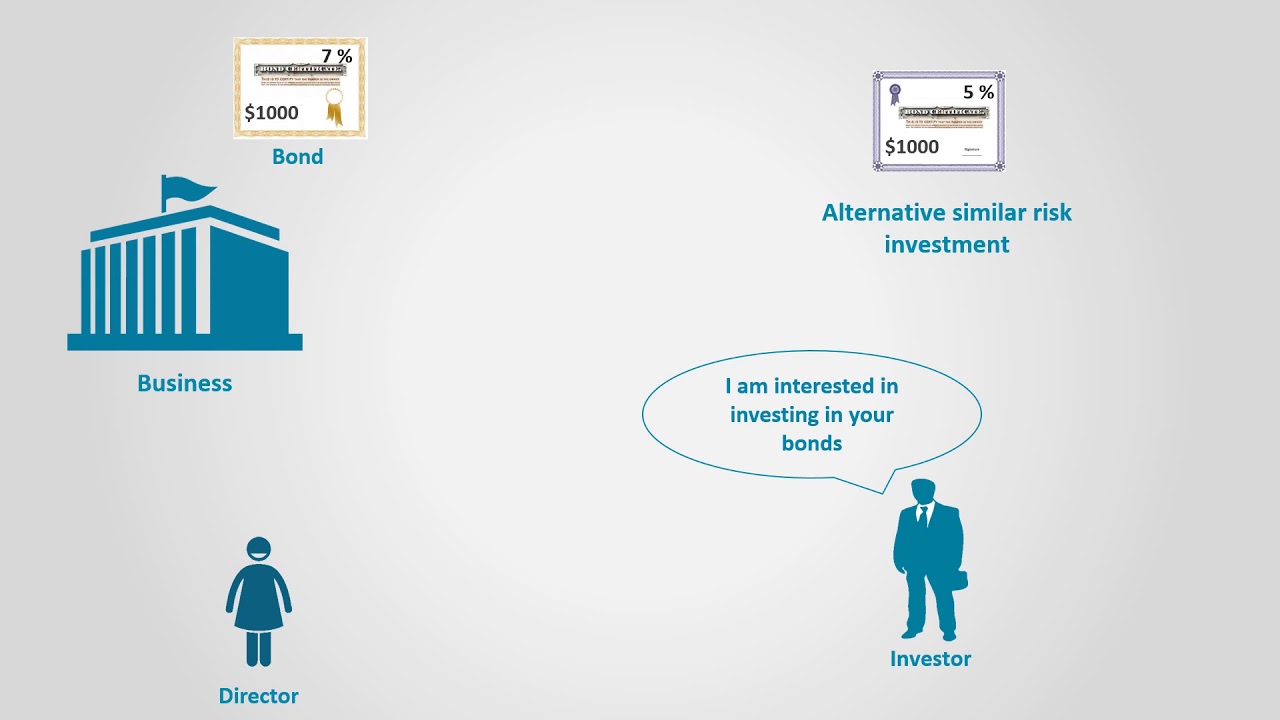

Discount on Bonds Payable Example

Images related to the topicDiscount on Bonds Payable Example

How are discounts and premiums on bonds payable accounted for?

Accounting for Bond Redemption

When it is time to redeem the bonds, all premiums and discounts should have been amortized, so the entry is simply a debit to the bonds payable account and a credit to the cash account.

How should a bond premium be reported on a statement of financial position?

Bond premium should be reported in the statement of financial position O at the present value of the future reduction in bond interest expense due to the premium. O along with other premium accounts such as those resuilting from share capital transactions.

How do you record premium on bonds payable?

The account Premium on Bonds Payable is a liability account that will always appear on the balance sheet with the account Bonds Payable. In other words, if the bonds are a long-term liability, both Bonds Payable and Premium on Bonds Payable will be reported on the balance sheet as long-term liabilities.

Is discount on bonds payable a current asset?

Although Discount on Bonds Payable has a debit balance, it is not an asset; it is a contra account, which is deducted from bonds payable on the balance sheet.

What is a premium on bonds payable?

Premium on bonds payable is the excess amount by which bonds are issued over their face value. This is classified as a liability on the books of the issuer, and is amortized to interest expense over the remaining life of the bonds.

See some more details on the topic How should discount on bonds payable be reported on the financial statements premium on bonds payable? here:

Accounting For Bonds Payable – principlesofaccounting.com

Use the straight-line method to account for a bond issued at a discount. Understand how bonds are presented on a balance sheet, whether issued at par, a premium …

Discount on Bonds Payable: All You Need To Know [+Examples]

In the financial statements, Discount on Bonds Payable contra-liability reduces the Bonds Payable liability balance sheet line-item in order to report the net …

Bonds Payable – A guide to understanding bonds to be repaid

If a bond is issued at a premium or at a discount, the amount will be amortized over the years through to its maturity. On issuance, a premium bond will create …

Bonds Payable – Accounting Principles II – Cliffs Notes

After the payment is recorded, the carrying value of the bonds payable on the balance sheet increases to $9,408 because the discount has decreased to $592 …

Bonds Premium and Discounts (Financial Accounting)

Images related to the topicBonds Premium and Discounts (Financial Accounting)

What type of account is discount on bonds payable and what is its normal balance?

The account Discount on Bonds Payable (or Bond Discount or Unamortized Bond Discount) is a contra liability account since it will have a debit balance. Discount on Bonds Payable will always appear on the balance sheet with the account Bonds Payable.

Why is discount on bonds payable a liability?

A contra liability account that reports the amount of unamortized discount associated with bonds that are outstanding. The discount on bonds payable originates when bonds are issued for less than the bond’s face or maturity amount.

What are the two methods of amortizing discount and premium on bonds payable explain each?

Effective-interest and straight-line amortization are the two options for amortizing bond premiums or discounts. The easiest way to account for an amortized bond is to use the straight-line method of amortization.

Are premium on bonds payable current liability?

If the fair value differs from what the company has calculated using the allowance method, the company must disclose it in its financial statements. In other words, if the bonds are a long-term liability, both Bonds Payable and Premium on Bonds Payable will be reported on the balance sheet as long-term liabilities.

When bonds are issued at a discount the bonds payable account is credited for the proceeds from the issue?

When bonds are issued at a discount, the bonds payable account is credited for the proceeds from the issue. If a long-term note payable has a stated interest rate, that rate should be considered to be the effective rate. Amortization of bond premium reduces the balance in bonds payable.

Discount Bonds Payable Effective Interest Method

Images related to the topicDiscount Bonds Payable Effective Interest Method

Which statement is true about a premium on bonds payable?

Answer and Explanation: It is true that a premium on bonds payable d) decreases when amortization entries are made until its balance reaches zero at the maturity date. The premium is tracked by both investors and issuers of bonds and it is a contra-liability account.

When bonds are issued at a discount?

A bond issued at a discount has its market price below the face value, creating a capital appreciation upon maturity since the higher face value is paid when the bond matures. The bond discount is the difference by which a bond’s market price is lower than its face value.

Related searches to How should discount on bonds payable be reported on the financial statements premium on bonds payable?

- is discount on bonds payable a current liability

- is premium on bonds payable a contra account

- unamortized discount on bonds payable balance sheet

- how to calculate discount on bonds payable

- in the balance sheet the account discount on bonds payable is

- is premium on bonds payable a current liability

- amortizing the discount on bonds payable

- in the balance sheet, the account discount on bonds payable is

- what type of account is premium on bonds payable

Information related to the topic How should discount on bonds payable be reported on the financial statements premium on bonds payable?

Here are the search results of the thread How should discount on bonds payable be reported on the financial statements premium on bonds payable? from Bing. You can read more if you want.

You have just come across an article on the topic How should discount on bonds payable be reported on the financial statements premium on bonds payable?. If you found this article useful, please share it. Thank you very much.